I am often asked to estimate the total closing costs involved in purchasing a home. Many of my clients are first time homeowners and don’t have the experience of working with lenders or going through the entire escrow process. Relatively early in the real estate journey, I will request a ‘buyer net sheet’ from the title company to estimate all of the costs associated with a transaction to give home buyers a better understanding of how much they will actually spend at the conclusion of the deal.

Since there are a number of nuanced line items that go into calculating the net financial outcome, I thought it would be useful to work through a hypothetical example to help home buyers understand the details.

I want to reiterate that this is merely an example and the actual numbers and cost categories may vary for any given transaction. As a party to a real estate transaction you should always check with your lender or escrow officer if you have specific questions.

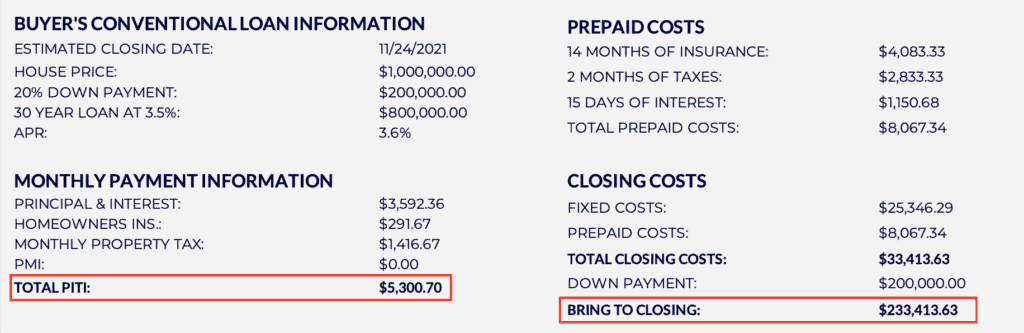

With that said, here is an example of a buyer net sheet:

In this hypothetical example the buyer is purchasing a home for $1,000,000 and putting 20% down or $200,000 and borrowing $800,000. They are taking out a 30 year loan at an interest rate of 3.5%.

The primary purpose of this document is to estimate both the total monthly expense of paying the mortgage and associated costs, and understanding how much cash will be required to close the transaction.

Loan Information

The net sheet starts with a simple summary of your loan. It states the property price, downpayment, loan amount with interest rate, and APR or annual percentage rate. The interest rate is the amount of interest you pay on the loan principal and is almost always a smaller number than the APR. The APR reflects the total cost of the loan including broker fees, closing costs, and points. When comparing loans, you really want to be comparing the APR as this is a more accurate measure of the total loan costs over time.

Points

Points are effectively a way of prepaying mortgage interest so that you reduce your monthly cost over the lifetime of the loan. A point represents 1% of the loan amount. Each point typically lowers the rate by 0.25. For example, if you borrow $800,000 at a 3.5% interest rate, but want to ‘buy down’ the interest rate to 3% you would purchase 2 points for $16,000.

This money would be added to your closing costs, but your monthly mortgage payment would go from $3,592 down to $3,372. Make sure to speak with your lender or mortgage broker about the specifics of your loan as there are limits on how many points you can purchase.

Monthly Payment Information

As a homeowner with a mortgage, you will have monthly expenses that are referred to as Total PITI which stands for Principal, Interest, Taxes, and Insurance.

- Principal – This is the amount of your mortgage payment that goes to repay the principal balance. This amount will change over time. For most loans you will pay a larger portion of interest early in the loan amortization, and a larger portion of the principal over time.

- Interest – The portion of your monthly loan payment that goes toward interest on the loan. As long as you have a fixed-interest rate loan, your total monthly payment to your mortgage servicing company won’t change, just the ratio of principal and interest. Note that mortgage interest is deductible from your taxes. Consult your tax account for more information on how to take advantage of this deduction.

- Taxes – The average monthly amount of property taxes you will pay. In California, property taxes are split into two payments. The first payment is due on November 1st (with a grace period until December 10th) and the second payment is due on February 1st (with a grace period until April 10th).

- Insurance – The amount of property insurance, also known as hazard insurance, that you’ll pay each month. Any conventional mortgage will require that you carry property insurance to protect the lender’s investment.

Since mortgage principal and interest payments will be combined together and paid directly to your loan servicing company, this is reflected as a single value in the circle chart.

Closing Costs

There are two categories of closing costs in addition to your down payment, pre-paid costs and fixed costs.

Prepaid Costs

These numbers vary depending on a variety of factors but often include pre-payment of homeowners insurance, property taxes, or interest. Most lenders will require that you pay for the first year of hazard insurance upfront. There also may be an opportunity to open an impound account where you will deposit funds to cover insurance and property tax expenses. By having these funds in a separate account, your lender will be confident of your ability to pay those key expenses and in some cases may offer you a reduced interest rate on the mortgage. Check with your lender or mortgage broker for more information.

Other than insurance, the other prepaid amounts won’t be accurately calculated until the very end of the escrow process. Depending on the specific date of the close of escrow, the amount of prepaid interest and property taxes can vary. In most cases the closing date will not be on the same day of the month as your mortgage payment is due, so there can be either a debit or credit in prorated interest payments on your final closing statement.

Fixed Costs

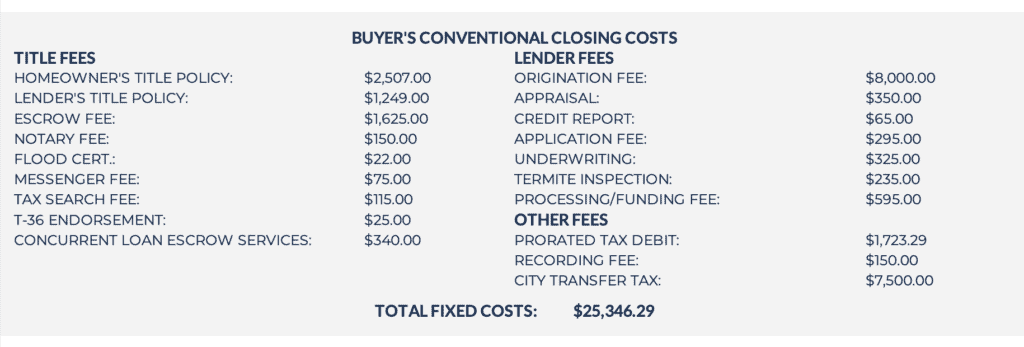

The fixed costs on your loan include three categories of fees: Title Fees, Lender Fees, and Other Fees.

Title Fees

When getting a mortgage you will be required to purchase title insurance for both yourself and for the lender. This insurance protects both parties in the event that a defect in the chain of title custody is ever discovered. An example of this is a former owner who makes a claim to the property or a tradesperson who secured a lien against the property for past non-payment. It is the responsibility of the title company to perform a title search to ensure the title is clear, but mistakes are occasionally made. In theory you can shop for title insurance, but most borrowers accept the policies issued by their title company.

Escrow Fee

This is the fee the title company charges to conduct the escrow and distribute funds to all of the parties. Note that in some states title and escrow companies are separate entities, but in California it is common to see these services combined. Consequently, you will often hear the terms ‘Title’ and ‘Escrow’ used interchangeably, although they are technically separate functions.

Notary Fee

Loan documents must be notarized by a public notary and there is a fee charged for this service. In many cases the title company will send a mobile notary to a location that is convenient for you to sign the documents so you don’t need to go to the Title office.

Other Title Fees

Depending on your location, title company, and lender, there are usually other small fees charged for messengers, searches, or environmental lien endorsements. These fees generally total a few hundred dollars and are not a material cost of most closings.

Lender Fees

Every lender will charge for different things, but in general these are fees you pay to the lender to provide you with a mortgage. Most mortgage providers make most of their money from these fees, not from the interest charged on the loans.

Origination Fee

By far, the largest fee in this category will be the loan origination fee. This fee is generally around 1% of the loan amount, but can vary depending on the lender. Therefore, if you are borrowing $800,000 you will pay around $8,000 for the loan origination fee. Check with your lender or mortgage broker to see if you can find products that offer lower origination fees. Note however, that banks will often make up for lower origination fees by charging higher interest rates. This is why the APR is the most important metric to consider when comparing loans.

Appraisal Fee

Mortgage lenders will require an appraisal on your subject property to ensure they do not loan above a particular loan-to-value ratio (LTV). Most banks will not lend more than 80% of the value of a property, so if you are purchasing a property for $1,000,000 with 20% down ($200,000), the bank won’t lend more than $800,000. Therefore, if the property appraised at $900,000 the bank would only be willing to loan $720,000.

They set this LTV to protect themselves in the event the borrower defaults on the loan and the bank has to foreclose on the property to recoup their capital. Appraisal fees vary by area and appraiser, but be prepared to pay up to $1,500 or more for this service in the inner east bay.

Other Lender Fees

There may be other fees for underwriting, applications, inspections, or processing. As with the other title fees, these additional fees are a relatively small portion of the total lender costs, with origination fees generally being the single largest line item.

Other Fees

Transfer Taxes

The primary component of this last category of fees are transfer taxes. There are both county and city transfer taxes due when a property changes hands. All counties in California charge the same amount of transfer tax which is $1.10 per $1,000 of assessed value. This means if the house you purchase costs $1,000,000, the county transfer tax would equal $1,100. It is customary in Northern California that the seller pays the county transfer taxes.

More significantly are city transfer taxes. These are customarily split between the buyer and the seller. Each city determines transfer tax amounts, but in the city of Berkeley the fees are 1.5% of the assessed value for properties up to $1.5M and 2.5% of the assessed value for properties above $2.5M. In the example we are using of a property that sells for $1,000,000 the city of Berkeley the transfer tax would be $15,000 of which the seller would pay $7,500.

While there may be other minor fees for recording the deed with the county assessor’s office or modest prorated credits, transfer taxes make up the bulk of these costs.

Conclusion

In the end the net sheet will estimate the total transaction costs and how much cash will be required at closing. The ‘cash to close’ includes:

- The down payment amount (minus any earnest money deposit already paid)

- Fixed costs

- Prepaid costs

You should expect your total closing costs to be between 3% and 5% of the loan amount, so if you are borrowing $800,000 the total closing costs will be roughly between $24,000 – $40,000. These costs may be even higher if you purchase points. While this is a lot of money, it is the cost of procuring a home loan and shouldn’t deter you from investing in property. In addition to the appreciation you will experience over time, there are tax deduction benefits from mortgage interest, property taxes, and depreciation.

In some cases, home buyers choose to roll the closing costs into the loan so they don’t have to come out of pocket at the close of escrow. This can be fine if you are tight on cash, but note that you will be paying interest on all of those costs throughout the life of the mortgage which will increase your monthly expenses, so be careful about this decision and make sure you understand the implications for your budget.

As mentioned earlier, the net sheet is just an estimate and actual costs will be determined based on your lender and title company. Also the cost categories used in this article are illustrative of the types of fees you might encounter, but are not a literal list of exact fees you will actually be responsible for.

Make sure you reach out to your lender or mortgage broker with any questions about your loan, and talk with your escrow officer if you have questions on the escrow process. With this information at hand you’ll be better positioned to select the best financing product for your needs and avoid surprises when it comes time to close escrow.