Another month has flown by and that means it’s time for my September 2023 real estate market update. We saw some mixed news from the August Consumer Price Index report, a hold by the Federal reserve, and some possible recession indicators on the horizon. Mortgage interest rates remain elevated and we’re far from being out of the figurative woods in terms of the Berkeley real estate market. Let’s dive into the most recent data and look at some other trends that might provide clues on where the markets are headed in the months to come.

Current Market Conditions

The August CPI report was issued last week and saw year-over-year inflation rise for the second month in a row to 3.7%. Higher energy prices accounted for the majority of the increase and with the summer driving season coming to a conclusion, it will be interesting to see what the September CPI report brings. While top line inflation continues to concern economic watchers, core inflation grew at a more modest rate of 0.3% which was still a bit higher than analysts had expected. That said, the core number has seen year-over-year growth of just 4.3% which is down from July. The net is that inflation is moderating, but not yet approaching the target rate of 2% that has been set by the Federal Reserve Board.

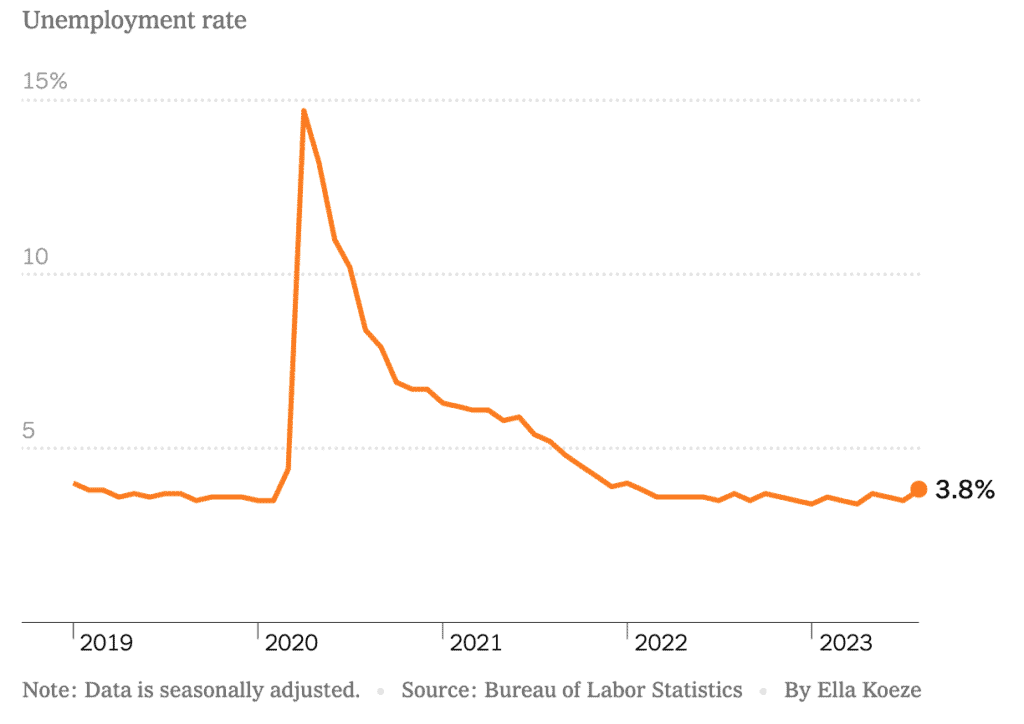

Interestingly, the August jobs report unexpectedly rose to 3.8% which is the highest we’ve seen since February of 2022. Part of this increase is definitely related to growth in labor force participation as the number of people entering the market for jobs increased by 736,000 from the prior month.

The increase in prices and corresponding increase in unemployment makes it harder to square the direction the economy may be headed.

And then today we heard the results of the most recent meeting of the Federal Reserve Open Market Committee. The Fed, as expected, chose to leave interest rates unchanged, but signaled that a final increase is still possible before the end of the year. This is consistent with what they have been forecasting since late spring, so the comment in itself does not seem to be cause for concern.

The Fed is clearly taking a ‘wait and see’ approach and may choose to hold interest rates at current levels for longer than hoped if economic activity continues apace. As Chairman Powell said at his press conference, “The worst thing we can do is fail to restore price stability”. In other words, don’t hold your breath for rate cuts anytime soon. However, there are some other indications in the economy that a ‘soft landing’ may not be in the cards.

Recessionary Winds

There are a number of leading indicators that are pointing to a possible recession in the coming months. Here are a few interesting data points for your consideration:

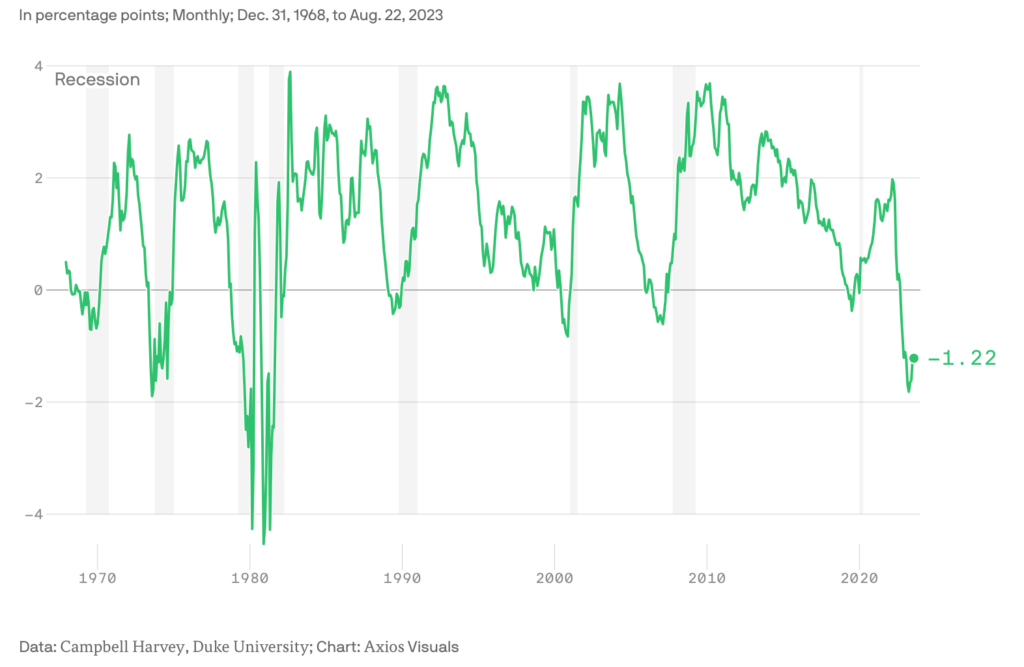

- Inverted yields continue As I first discussed in my July market update of this year, the spread between the 3-month and 10-year treasury bond yield remains inverted. That means that the interest paid on a short term bond is more than that of a 10-year bond. A recession has followed the bond yield inversion every time over the last 50 years. While the spread between the 3-month and 10-year bond has dropped from 2% in May to about 1% today, this data still implies that we may be just around the corner from a recession.

- The Sahm Rule. Invented by former Fed staffer Claudia Sahm, the rule is a handy real-time indicator of recession. Her observation was that when the three-month national average of the jobless rate is more than 0.5 percentage points higher than the lowest unemployment rate over the last year, it’s an almost foolproof sign that a recession is underway. We find ourselves in that situation right now.

- Personal spending is about 70% of U.S. economic activity and many economists attribute the excessive savings that consumers built up during the pandemic to our ongoing economic strength. That may be about to change. The Federal Reserve Bank of San Francisco recently estimated that the $2.1 Trillion in accumulated savings is nearly depleted. This could mean lower spending in the months ahead, and thus a decline in economic growth.

What This Means For Real Estate

The recent data is clearly mixed. While we see inflation remain stubbornly elevated, unemployment is also creeping up and there are indicators that the once hoped for ‘soft landing’ may turn into a much more bumpy descent. The Federal reserve is in an unenviable position of trying to tame price and wage growth, but not so much as to put large swaths of the labor force out of work due to declining consumer demand. For now interest rates remain stable, but the markets have already priced in this expectation meaning we are unlikely to see a reduction in mortgage interest rates in the short term.

The next question is when we might see the hoped for reduction in mortgage costs to unlock both pent up buyer demand and the release of property inventory from homeowners who feel locked-in by sub 3% refinances.

The Fed doesn’t want to undershoot on rate increases (or duration) only to see prices increase again, so they will remain cautious moving forward. However, there are some indicators that we may be headed toward recession which could result in rate decreases sooner than the Fed is currently forecasting.

Conclusion

Ultimately, the notion that you can’t time the market remains true. Rates will come down in the future, we just don’t know when. Home inventory remains limited, and even when rates decline, there will be a rush of demand to meet the increased supply, keeping home prices elevated. Even worse, housing starts remain soft so little help is on the horizon in the terms of more inventory (and there’s almost nowhere to build in the inner east bay anyway).

In short, home values are forecast to remain healthy and continue to appreciate in the years ahead. Combined with the eventual decline in mortgage interest rates and the option to refinance, it is always better to begin building equity sooner rather than later. Don’t let the ups and downs of the daily markets cloud your long-term vision.

I can help you evaluate your next move and consider how all of these economic factors may impact your real estate investment strategy. I love talking with clients about their real estate journey and invite you to reach out if you have any questions or just want to get more flavor on my interpretation of the economic data.

As always, I’ll continue to provide regular market updates so until next month, keep it real!