With the presidential election in the rearview mirror, I now turn my attention to how the economy may be impacted by the proposed policies of the incoming administration. In my November 2024 real estate market update, I’ll be taking a look at the most recent economic reports, what key Republican policy proposals might mean for interest rates, and how all of these factors may influence the local real estate market.

Current Market Conditions

The U.S. economy continues to exhibit robust growth, with the composite Purchasing Managers’ Index (PMI) reaching 55.3 in November, the highest since April 2022, indicating strong expansion in both services and manufacturing sectors. This growth is bolstered by expectations of corporate tax cuts, tariffs, and deregulation, leading to increased business confidence and a strengthening dollar.

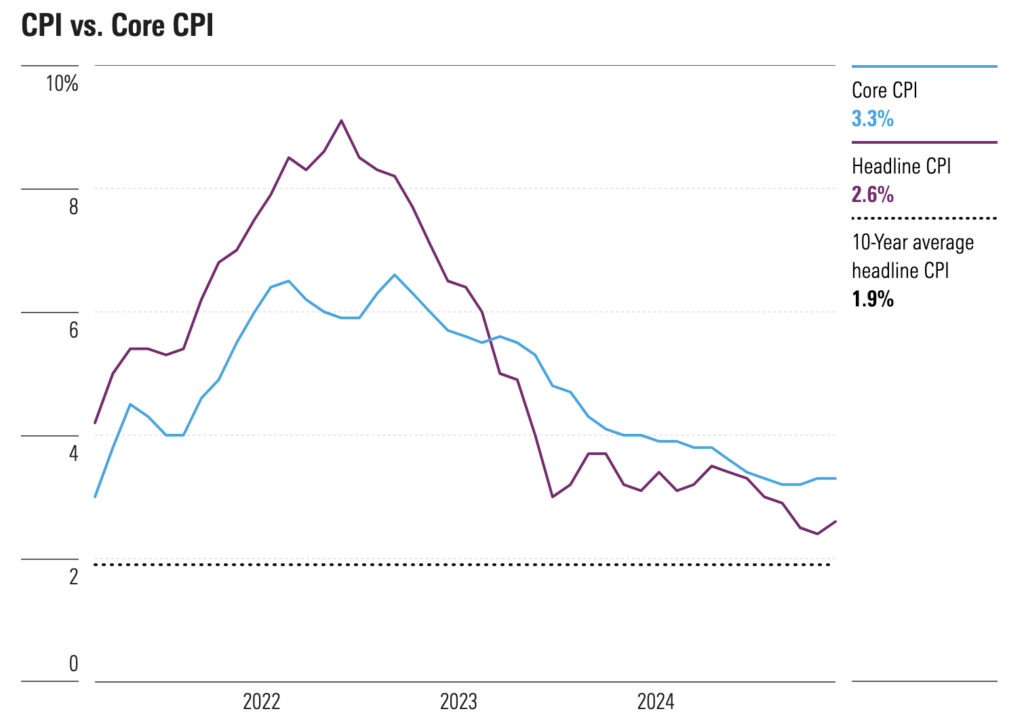

In October 2024, the U.S. Consumer Price Index (CPI) increased by 0.2% from the previous month, marking the fourth consecutive month of such growth. This brought the annual inflation rate to 2.6%, up from 2.4% in September. Core CPI, which excludes volatile food and energy prices, ticked up by 0.3% month-over-month, consistent with the prior two months, resulting in a 3.3% year-over-year increase.

As I’ve discussed in previous market updates, shelter costs remain a significant contributor of CPI growth, increasing by 0.4% in October and accounting for over half of the monthly all-items rise. The food index also grew by 0.2%, with food at home up 0.1% and food away from home up 0.2%. Energy prices remained unchanged over the month but that is likely to change in the next few months as we get into the winter heating season.

Inflation has moderated, with the core Personal Consumption Expenditures (PCE) index declining to approximately 2.25%, approaching the Federal Reserve’s target. The Federal Reserve has responded by reducing the federal funds rate twice in the past few months, with projections indicating further cuts, potentially bringing the rate to 3.4% by mid-2025.

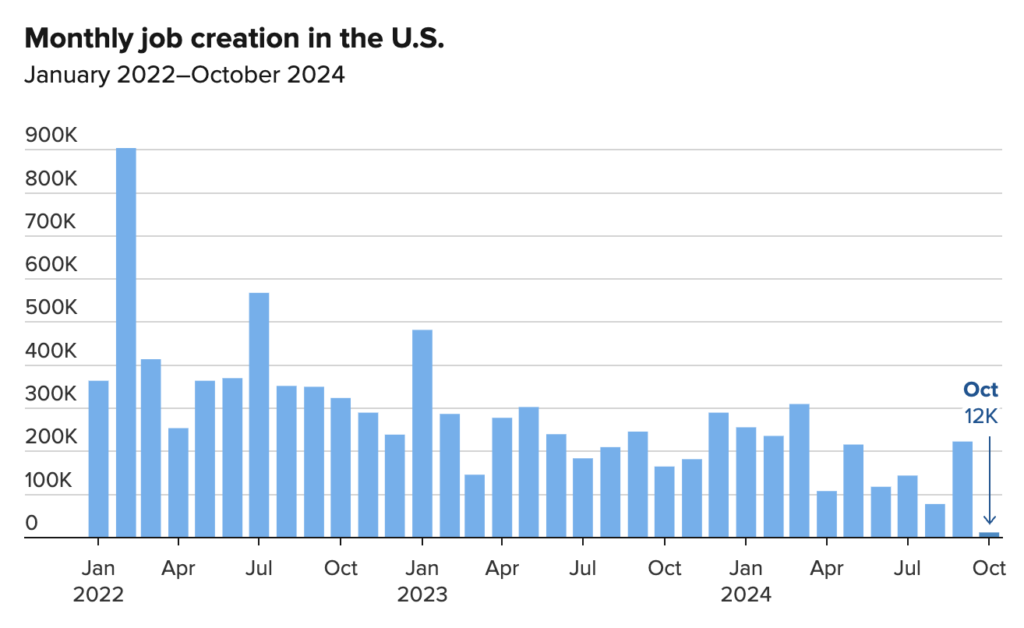

The labor market added just 12,000 jobs in October which was the slowest growth since 2020 and was well short of the expected 100,000 increase. That said, unemployment rates remained steady at 4.1%, and real disposable income growth nearing 3%. The modest job growth is attributed to disruptions from hurricanes and strike activities, notably in the manufacturing sector. Despite these challenges, the labor market shows resilience, with steady unemployment rates and wage growth.

These figures suggest that while inflation is above the Federal Reserve’s 2% target, it remains relatively stable. The Federal Reserve is expected to continue its current monetary policy approach, with market participants anticipating a potential interest rate cut in December.

What’s Next for the Fed?

Donald Trump has made clear that he intends to implement across-the-board tariffs of around 10% and it may well be much higher for goods that come from China. In addition, he has stated that he intends to extend the tax cuts that his administration shepherded through congress in late 2017. These cuts were originally scheduled to expire at the end of 2025, but if extended could add $4.6 Trillion to the deficit over 10 years.

In the long term, this policy mix could result in higher government deficits due to tax cuts, potentially increasing the federal debt burden. Rising interest rates in response to inflation could exacerbate the cost of servicing this debt, further straining fiscal sustainability. Additionally, prolonged tariff policies could erode global trade relationships and dampen business investment, limiting the economy’s growth potential.

The Federal reserve board has historically followed a dual mandate of full employment and price stability. The Fed has also been largely independent for more than one hundred years since the Federal Reserve Act was signed into law by President Woodrow Wilson in late 1913.

That independence may be called into question under the new administration. Trump has historically expressed dissatisfaction with the Federal Reserve’s independence. While the Federal Reserve operates as an independent central bank, insulated from direct political influence, Trump’s statements and actions often suggested he preferred a more hands-on approach to its decision-making, particularly regarding interest rates.

While Trump’s rhetoric and actions suggest a desire for greater influence over the Fed, the institution’s legal structure and long-standing norms protect its independence. However, persistent public criticism and political pressure can create market uncertainty and challenge the perception of the Fed’s autonomy.

A new Trump administration could exacerbate these tensions if it pursues aggressive fiscal or trade policies that complicate the Fed’s monetary decisions. Overall, Trump’s past behavior indicates a willingness to challenge the Federal Reserve’s independence, particularly when its policies conflict with his administration’s economic goals.

Impact on the Real Estate Market

While no one knows the exact impact of various fiscal policies of the new administration, in an environment of increased spending and reduced revenue, it’s a reasonable bet that interest rates will rise. How quickly this will happen is unknown, but given what we understand about the policy positions of Mr. Trump, I’m not feeling as confident as I once was that we will see lower mortgage interest rates in 2025. While it remains likely that the Fed will cut rates by 25 basis points at their December policy meeting, what happens as we round the corner into the new year and the next administration takes power is completely up in the air.

I’ve speculated that once mortgage interest rates drop below 6% we’re likely to see a loosening of home inventory as sellers become more willing to give up the lower refinanced rates of Covid pandemic era. While I started this fall off feeling confident we would see this happen in 2025, I’m now much more reticent to forecast this outcome.

I now think it likely that rates will remain in the 6% – 7%+ range for the foreseeable future and that an ongoing lack of inventory will continue to keep home buyers in highly competitive situations. This will likely mean lower transaction volume and ongoing high prices, particularly for turn key properties in great locations.

Conclusion

This implies that buyers should move aggressively to purchase while rates remain stable and before the new administration policies have an opportunity to impact inflation. Seller’s may feel less pressure to move given their historically low mortgage interest levels, but as rates increase fewer buyers will be available in the market which could have adverse impacts on home values.

Of course my standard advice remains the same. Don’t time the market. Let your personal family circumstances dictate your real estate needs, and make sure that you are working with an experienced, trusted real estate advisor when it’s time to transact.

If you have any questions, or want to challenge my assumptions on how macro economic trends are likely to impact the real estate market, reach out for a conversation. I love to talk about this stuff with my community and I always learn something new from other perspectives. I look forward to hearing from you and wish you and your family a happy and health Thanksgiving season!