The economy never rests which means it’s again time for my March 2023 real estate market update. And how quickly things change. Last week saw Federal Reserve Chairman Jerome Powell testifying before congress and indicating that further interest rate hikes may be warranted based on February CPI and jobs data. This led to an increase in mortgage interest rates and a stock market decline as investors began pricing in more expensive borrowing costs.

And then came the Silicon Valley Bank (SVB) collapse. That fact has certainly changed the complexion of the economic decisions facing the Fed in the coming weeks and months. We now also have a new Consumer Price Index report to digest and factor into the dynamics that influence the local real estate market. With that preamble out of the way, let’s jump in.

Current Market Conditions

Let’s quickly tackle the SVB collapse before discussing the new CPI report. SVB saw a large influx of deposits during the pandemic years as many of their technology company clients experienced record profits. The bank chose to invest some of those funds in government treasuries at quite low yields (the interest paid on government debt). Over the past year as the Fed increased interest rates and tech companies began to struggle amidst inflation, many of these firms began to withdraw money from SVB to fund operations. This left the bank short on liquidity (cash reserves to cover client withdraws).

When SVB went to sell some of their government bonds to raise capital, they found the market wasn’t interested in buying bonds at low interest rates as bond yields had risen considerably in the intervening period. This meant that SVB had to sell these assets at a loss. When their March financials were released announcing these losses, many customers began to fear that the bank would become insolvent so they quickly pulled their savings which led to a run on the bank. Ultimately the FDIC stepped in to cover customer deposits.

Just a couple of days later the March 2023 Consumer Price Index report was released. The headlines from the report show that inflation dropped to 6% in February, down from 6.4% in January which was essentially what analysts were expecting. However if we dig a little deeper we see that the core inflation index, which excludes volatile food and energy prices, actually INCREASED by 0.5%. Of that core inflation measure, the shelter category accounted for 60% of the increase.

Why It Matters

Following Chairman Powell’s congressional testimony last week, markets appeared to be expecting up to a 0.5% fed rate increase at the upcoming Federal Open Market Committee (FOMC) meeting. The CPI data showing ongoing inflation concerns would normally serve to reinforce that perspective. However, concerns with the banking sector, which are heavily impacted by rate increases, may lead the Fed to adopt a more conservative approach to the inflation challenges.

Frankly, the Fed is in a very difficult spot. If they have to choose between fighting inflation and protecting the economy from a banking collapse, chances are they will error on the side of caution and any rate increases announced next week will be modest, more on the order of 0.25% than the previously anticipated 0.5%.

Markets rebounded following the CPI report, including some regional bank stocks which were battered the past couple of days as investors feared that other financial institutions may be impacted by the same exposure as SVB had. Overall the positive reaction by the markets imply that investors expect the Fed to proceed cautiously in the days ahead.

What This Means For Real Estate

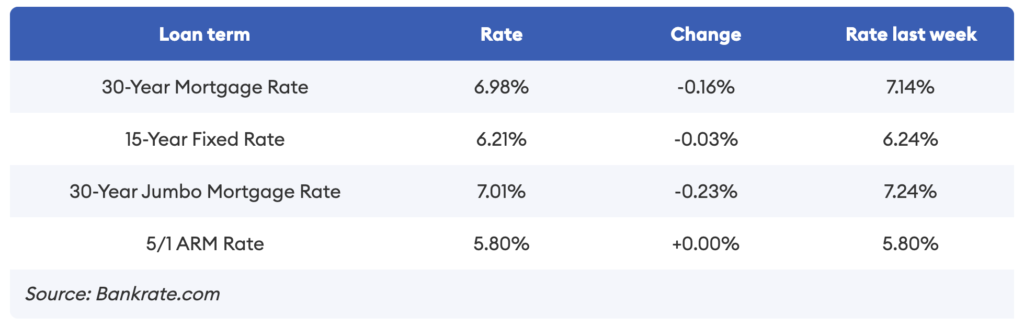

In general, as go the Federal Funds Rate, so goes mortgage interest rates. As investors retreat from stocks and invest in bonds, particularly mortgage backed bonds, mortgage interest rates tend to decline. That’s exactly what we’ve seen over the past couple of days, particularly with conforming loans.

Jumbo loans, which are non-conforming, meaning they aren’t backed by the government, are more expensive as they are considered by banks to carry more risk. Also, given the skittishness of the banking sector, many banks are likely to become more stringent about their lending standards meaning it will be harder for homebuyers who don’t have top credit scores to qualify for mortgages.

Also, just because you’ve been approved for a loan doesn’t mean the product will still be available when it’s time to pull the trigger. In general you should check with your loan officer on a regular basis to verify if the product you are looking at is still an option. It also may be a good idea to investigate alternative forms of financing, or financing from other institutions. It never hurts to have a plan B.

And One More Thing…

Clearly the economy is in a period of turmoil and the outcomes are highly uncertain. We will continue to get more pieces of the puzzle over the coming days and weeks, but it is unlikely mortgage markets will stabilize anytime in the foreseeable future. While this turmoil may be disconcerting, declining mortgage rates means you can afford more house for the same downpayment. Opportunities arise during uncertainty, so now may be an optimal time to buy if you are well qualified and can move quickly.

As for sellers, you may have read that due to rising interest rates, home values have declined over the past few months. While this is true in select markets, and even for the housing market on average across the entire country, it is not indicative of home values in Berkeley and the surrounding areas. We are still facing a sellers market with far more demand than supply, and in fact we have seen a rise in list prices over the past few weeks.

The combination of recently declining mortgage interest rates and limited inventory could mean it’s a great time to list your home if you are considering selling. It’s not too late to take advantage of the hot spring season, so let me walk you through the details. I’d love to provide you with a home valuation and discuss the listing process.

Conclusion

The next date to track will be the Federal Reserve Bard meeting on March 22nd when they will consider further interest rate hikes. If, as now expected, the Fed chooses no increase or a modest rate increase of 0.25% we are likely to see stable to declining mortgage interest rates.

Regardless of where you are in your real estate journey, I’ll continue to provide regular market updates, and don’t hesitate to reach out if I can answer any questions for you or your friends and family. Till next month!