Spring has arrived, and with it comes fresh insights into our evolving real estate landscape. For those who’ve been following my monthly updates (you can browse past reports here), you know we watch multiple factors that influence buying and selling decisions. Let’s dive into the latest developments—including some surprising findings about consumer confidence—and what they mean for your real estate plans.

Inflation Remains Persistent, Influencing Fed Policy

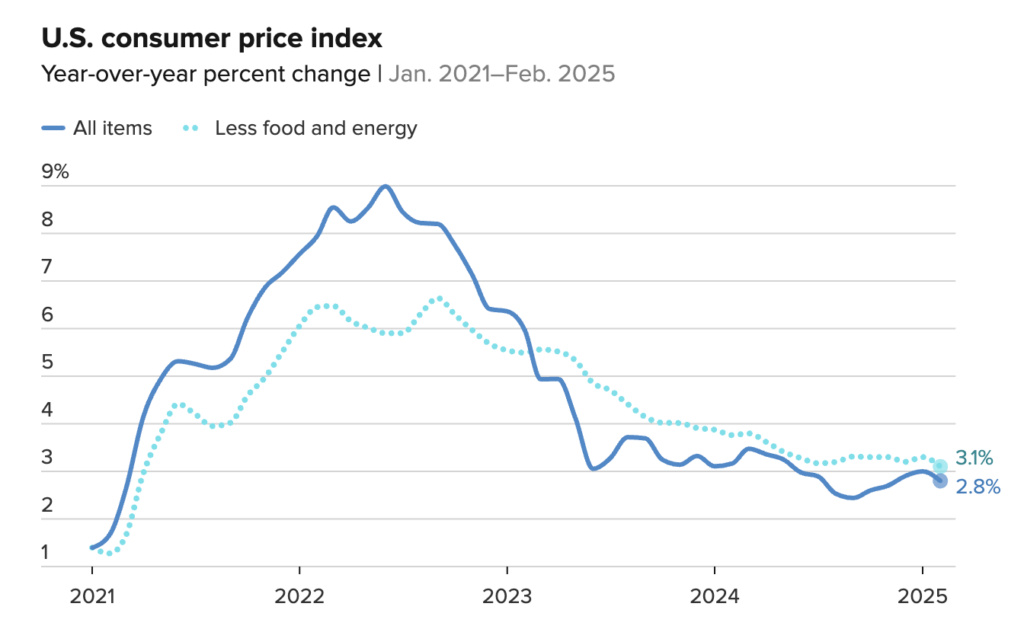

The February Consumer Price Index report from the U.S. Bureau of Labor Statistics showed a year-over-year increase of 3.1%, marking a modest deceleration from January’s 3.3% but still exceeding the Federal Reserve’s 2% target. Core inflation, which excludes volatile food and energy prices, remained elevated at 3.4%, driven largely by sustained increases in service sector costs such as healthcare and insurance.

This persistent inflationary pressure has led the Federal Reserve to maintain its cautious approach to interest rate cuts. Market expectations, as reflected in CME Group’s FedWatch Tool, now anticipate only two 25-basis-point reductions in 2025, a significant revision from earlier projections of three or four cuts.

We’ve seen mortgage rates take us on quite the ride recently. After dipping to 6.0% in February, rates have climbed back up to 6.2% this week according to Freddie Mac’s latest survey. This volatility stems from mixed economic signals – while the February CPI report showed inflation cooling slightly to 3.1%, it remains above the Fed’s target. Many buyers are asking me: “Should I wait for rates to drop?” My advice remains consistent – focus on finding the right home first, then we can strategize about rate opportunities.

Labor Market Shows Signs of Moderation

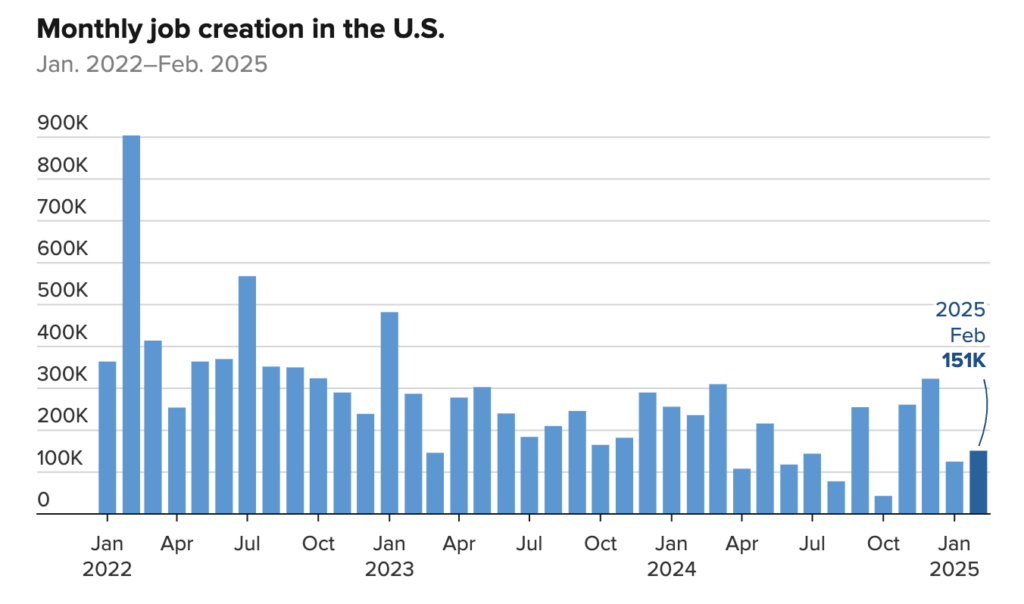

Recent employment data presents a mixed picture for the housing market. The February jobs report revealed an uptick in the unemployment rate to 4.1%, up from 3.9% in the fourth quarter of 2024. Job creation slowed to 180,000 new positions for the month, falling below the 2024 monthly average of 225,000.

However, wage growth has remained robust at 4.3% annually, according to the Atlanta Fed’s Wage Growth Tracker. While this outpacing of inflation is positive for workers, it continues to create affordability challenges in housing markets where price growth has consistently exceeded income gains. The combination of these factors suggests the economy is achieving the much-discussed “soft landing,” but the transition is creating new dynamics for both homebuyers and sellers.

Consumer Sentiment: A Mixed Bag of Confidence

Recent surveys reveal intriguing shifts in how Americans view the housing market. According to Fannie Mae’s latest Home Purchase Sentiment Index (HPSI), consumer confidence in buying a home has improved slightly, with 22% of respondents believing now is a good time to buy—up from 18% in January. However, a persistent 68% still consider it a “bad time” due to affordability concerns.

Meanwhile, seller optimism has dipped slightly. Only 58% of homeowners feel now is a good time to sell, down from 62% last quarter. This cooling enthusiasm aligns with what I’m seeing locally: some potential sellers are hesitating, worried they won’t find their next home in today’s competitive environment.

Why does this matter? Sentiment often translates into action—or inaction. When buyers and sellers grow cautious, markets can slow. But when confidence rebounds (as it did slightly this month), we often see a surge in activity.

Political and Policy Developments Add Uncertainty

The Trump administration’s recent policy changes are poised to significantly impact the housing market, particularly concerning mortgage rates, new home construction, and home prices. In February 2025, President Trump reinstated a 25% tariff on all steel and aluminum imports, effective March 12, eliminating previous exemptions and raising the aluminum tariff from 10% to 25%. While this move is intended to bolster domestic production, it is expected to drive up construction costs, which could lead to higher home prices and slow new housing developments. Additionally, the administration has proposed a 50% reduction in HUD funding, a move that housing advocates warn could reduce the availability of affordable housing and increase homelessness among vulnerable populations.

One of the most consequential shifts involves the potential privatization of Fannie Mae and Freddie Mac, which could result in higher mortgage rates if these institutions lose their government backing. William Pulte, the new head of the Federal Housing Finance Agency (FHFA), has already begun restructuring both entities, removing multiple board members and installing himself as chairman of both organizations. If privatization moves forward, government guarantees on mortgages could be removed, reducing access to low-cost financing. Combined with inflationary pressures from tariffs, this could lead to higher mortgage rates, increasing borrowing costs and potentially dampening homebuyer demand.

While these policy changes may benefit domestic steel and aluminum producers, they are likely to create headwinds for the housing market. Higher construction costs and increased financing expenses could slow new developments, exacerbating affordability issues in high-demand areas like Berkeley. Meanwhile, Federal Reserve officials have voiced concerns over inflation trends, suggesting that interest rate cuts may be delayed, keeping mortgage rates elevated for the foreseeable future. As these policies take effect, their full impact on the real estate sector will depend on how homebuyers, builders, and financial markets adapt to shifting economic conditions.

Local Market Dynamics

Berkeley’s real estate market continues to exhibit a complex blend of sustained demand and emerging caution. According to Redfin, the median sale price in Berkeley reached $1.43 million in February 2025, marking a 19.2% increase compared to the previous year. This appreciation underscores the city’s enduring appeal, yet the market dynamics reveal nuanced shifts.

A notable trend is the rise in all-cash purchases. While comprehensive citywide data is limited, certain Berkeley ZIP codes have seen significant cash transactions. For instance, in the 94709 ZIP code, 68% of home sales were all-cash deals in 2024, highlighting the influence of affluent buyers in specific neighborhoods. This trend contrasts with a regional decline in mortgage applications, suggesting a market increasingly driven by cash-ready investors and buyers.

The city’s unique characteristics further shape its housing landscape. Proximity to the University of California, Berkeley, adds a premium to nearby properties, although specific percentage increases are not detailed in the available sources. Additionally, policy measures like California’s Proposition 13 continue to influence property tax assessments, affecting long-term market behavior. These factors contribute to a scenario where well-maintained, strategically located homes attract competitive offers, while overpriced luxury listings may experience extended time on the market or necessitate price adjustments.

Looking Toward the Rest of 2025

Several key trends are likely to shape the housing market through the remainder of the year. Mortgage rates are expected to remain volatile, with most analysts projecting the 30-year fixed rate to fluctuate between 5.8% and 6.5% through 2025. The interplay between Fed policy and inflation data will be the primary driver of these movements.

The construction sector faces ongoing challenges, with the combination of tariffs and persistent labor shortages likely to constrain new housing supply. This dynamic may maintain upward pressure on prices despite moderating demand. At the local level, policymakers are increasingly exploring innovative solutions to affordability challenges, including density bonuses and down payment assistance programs, as federal action remains uncertain.

Strategic Considerations

For sellers in today’s market, pricing strategy is more critical than ever. The days of aggressive listing prices with built-in negotiation room are fading, replaced by a market that rewards realistic, well-positioned homes. Properly priced properties are still moving, while overpriced listings are stagnating, racking up days on market, and ultimately selling for less than they might have with a sharper initial ask. Buyers remain active, but they’re more discerning, and homes that don’t reflect current market realities risk getting overlooked.

For buyers, the decision-making process is anything but straightforward. Holding out for lower mortgage rates is tempting, but the risk of further hikes or continued home price appreciation could make waiting a costly mistake. Instead of trying to time the market perfectly, a more strategic approach is focusing on long-term affordability, personal financial stability, and securing the right home when it becomes available. The competition for well-located, move-in-ready homes remains fierce, and buyers who hesitate too long may find themselves paying more down the road.

Investors are also facing a shifting landscape. Rising insurance premiums, higher property taxes, and increased maintenance costs are squeezing margins, making it more important than ever to run the numbers carefully. The days of easy appreciation and generous cash flow assumptions are being replaced by a market that demands disciplined underwriting and a clear-eyed view of expenses. Those who adapt to these new realities—prioritizing well-located properties with strong rental demand and conservative financial models—will be best positioned to succeed.

Conclusion

As always, real estate remains fundamentally local in nature. For those considering a move in the near term, a detailed analysis of neighborhood-specific trends can reveal opportunities that broader market data might obscure. I’ll continue to monitor these developments closely and provide updates following April’s Federal Reserve meeting and the next round of economic data releases. In the meantime, if you have any questions or would like a market valuation of your current property, reach out for a consultation.