What a rollercoaster the past month has been! A catastrophic debate, an attempted assassination, a vice-presidential pick, a campaign resignation and more. We’ve also seen quarterly earnings reports from a couple of big tech companies that have had a bearish impact on the stock market, along with a slew of economic data that provides some indication of where the economy is headed in the months ahead.

This means it is past time for my July 2024 Real Estate Market Update. I was vacationing with my family in Asia the earlier part of the month, so this update is coming a bit later than usual. Part of that timing is that I have been waiting for some fresh reports to hit so I can provide a comprehensive update with the most recent information. So here we go…

Current Market Conditions

A flurry of new economic data was released in the past few weeks, both for the month of June and the 2nd quarter of 2024. Here is the summary of the most relevant reports:

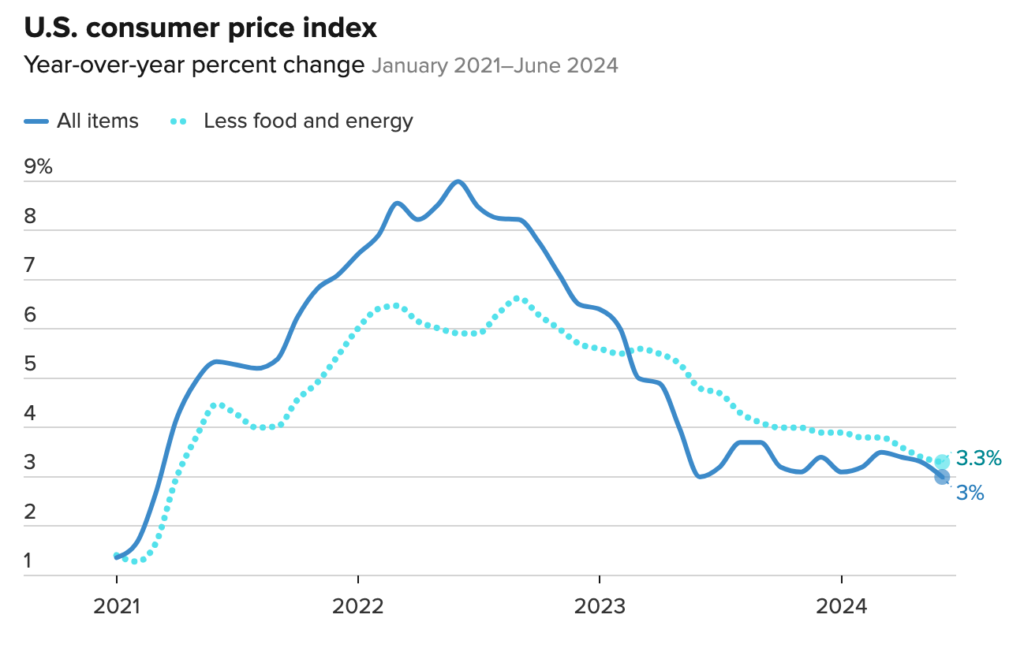

- The June Consumer Price Index report was released on July 11th and showed a decrease in inflation from the prior month. This is the first time in over four years that the CPI has seen a monthly decrease. While the decrease was a modest 0.1%, the year-over-year inflation change was around 3%, the lowest in 3 years. The core index grew just 0.1% and while food and shelter costs increased modestly, energy costs dropped nearly 4% from the prior month.

- While consumers had something to celebrate, producers were not as fortunate. The Producer Price Index saw a 2.7% increase since the beginning of the year. Economists were expecting a slight increase from May’s 2.2% lift and were caught off guard by more rapidly increasing input costs.

- The U.S. economy added 206,000 jobs in June, down slightly from an adjusted 215,000 in May. The June jobs report also noted that the unemployment rate ticked up 0.1% to 4.1%. This is the first time the unemployment rate has exceeded 4% since November of 2021. This is seen as another sign that economic growth is gradually slowing.

- 2nd quarter Gross Domestic Product (GDP) or the value of all goods and services generated by the U.S. economy, grew 2.8%, substantially exceeding forecasts of a 1.9% increase.

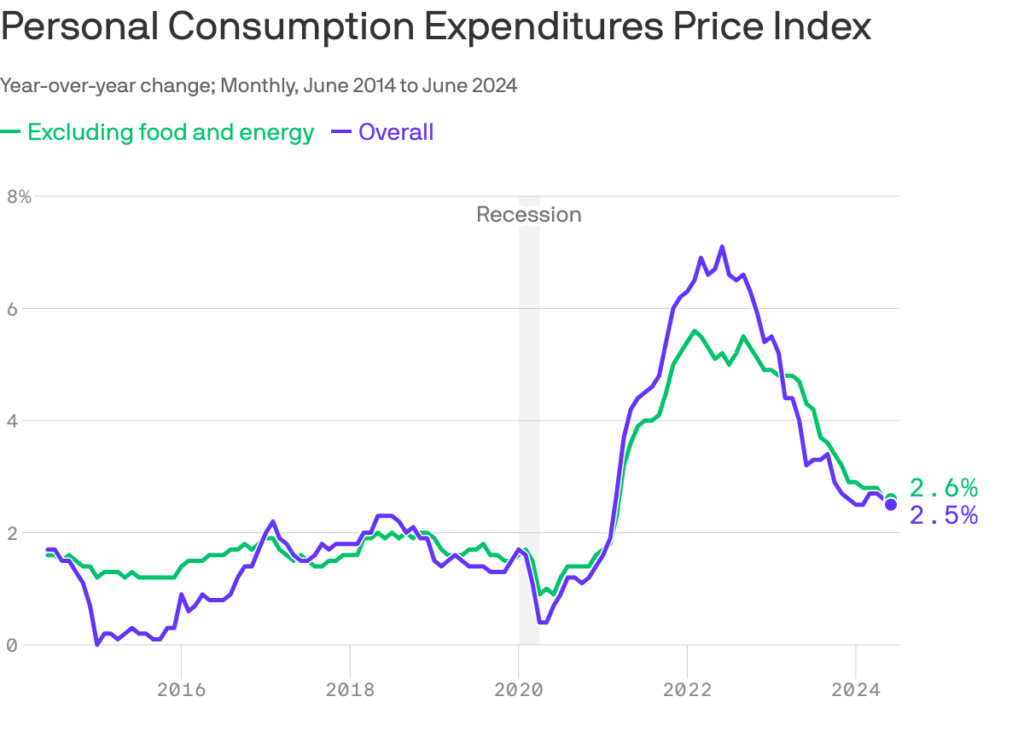

- Today saw the release of the Fed’s preferred inflation measure, the Personal Consumption Expenditures Price Index. In June, PCE inflation was 0.1%, with core inflation (excluding food and energy) at 0.2%. Over the past year prices increased by 2.5%. This is a significant improvement from the 4.5% rate in the January-March period and the 2.9% rate in the March-May period.

What’s Next?

While inflation jumped slightly in Q1, it now appears that this was a temporary anomaly. General economic trends have shown decreasing inflation along with relatively strong wage growth, stable employment, and steady but modest economic output. This is more or less exactly what the Fed has been aiming for in its policy to increase interest rates without pushing the economy into recession.

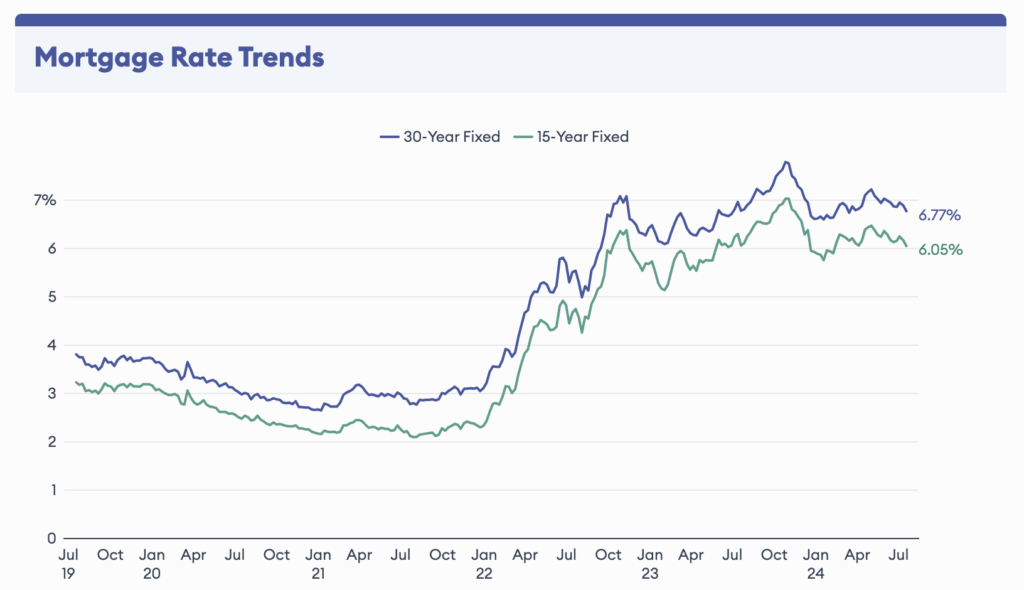

The next Fed Open Market Committee (FOMC) meeting is scheduled for next week and most economists expect interest rates to remain unchanged, even in light of the recent data indicating that inflation is under control and that the economy appears to be slowing. Fed watchers, however, are highly confident of at least a 0.25% interest rate cut at the following FOMC meeting on September 19th. There is a chance we see a second cut before the end of the year, but that will depend on future economic data.

Of course another factor may have a substantial impact on future interest rates, and thus the housing market: The presidential election. The current Republican platform is considering across the board tariffs on foreign goods which could renew inflationary pressures. It is unclear if there will be a peaceful transfer of power following the November 5th voting, and it could be well into January before we know the final results. In a tightly contested race with a highly uncertain outcome, markets typically slow down.

Regardless of what the Fed chooses to do through the end of 2024, the economic wildcard remains which political party takes power in January.

The Impact On Real Estate

We’ve seen a gradual reduction in mortgage interest rates over the past few months as markets price in future Fed interest rate reductions. That said, 30-year fixed mortgages are still running well above 6.5% while home prices remain elevated. This has kept affordability out of reach for many buyers. While home inventory has crept up a bit in the past few months, we are experience typical summer doldrums when many people are traveling and real estate transactions slow down.

We have also seen an early start to the fall fire season led by the Park Fire near Chico which has already burned more than 125,000 acres. A relatively dry spring followed by a hot summer portends a long period of conflagrations through the fall which could have negative impacts on home sales.

The fall selling season usually picks up around Labor Day and I expect this year to be no exception. However, due to the election, the window for transacting will likely be shorter this year as markets will likely contract leading into the first week of November. That doesn’t mean there aren’t opportunities to buy or sell in November and beyond, but with fewer active buyers and sellers it may be harder to find appropriate homes to purchase or enough demand for your listing.

Conclusion

So what’s new? In some ways, not much. The economy is moderating, interest rates are likely to come down soon, the real estate market is tight, but relatively healthy, and uncertainty looms for the upcoming presidential election. This has been the state of things for much of the year and thus my advice on real estate remains the same. Take a long-term approach to investing, do what makes the most practical sense for your family, and follow the advice of your trusted real estate advisor.

You can’t time the market but we know something about the fundamentals that remain consistent. The inner east bay is an attractive place to live and there will be limited inventory for the foreseeable future. Interest rates are coming down and future refinancing always remains an option. Property appreciation beyond 5 years nearly always beats the stock market, and homeownership is a great way to build wealth.

Don’t let concerns about the macroeconomy or the national political environment dissuade you from considering buying or selling a home. Those trends are short-term and will constantly change, while homeownership is a long-term investment in the future of your family. Please contact me to discuss your personal situation and we can play out various scenarios and how they might impact your future plans. I love to brainstorm with my clients and I find that you can get great clarity by just having conversations with a local expert. I look forward to speaking with you soon!