Summer is flying by which means it’s time for my July 2023 real estate market update. I’m going to start by reviewing results from the June Consumer Price Index (CPI) report as well as the recent jobs report. Unlike most of my previous market updates, I want to then move on to discuss longer term trends in the macro economy and what these might imply for the future of the real estate market.

Current Market Conditions

The U.S. Bureau of Labor and Statistics released the June CPI report last week which showed year-over-year inflation grew just 3% compared with more than 9% from June of 2022. Inflation has now decreased every month over the past year and the June report slightly beat analysts expectations of inflation rates of 3.1%. While the core inflation rate, which excludes food and energy, was down slightly to 4.8% but is still seen as considerably higher than the Federal Reserve’s target rate of around 2%.

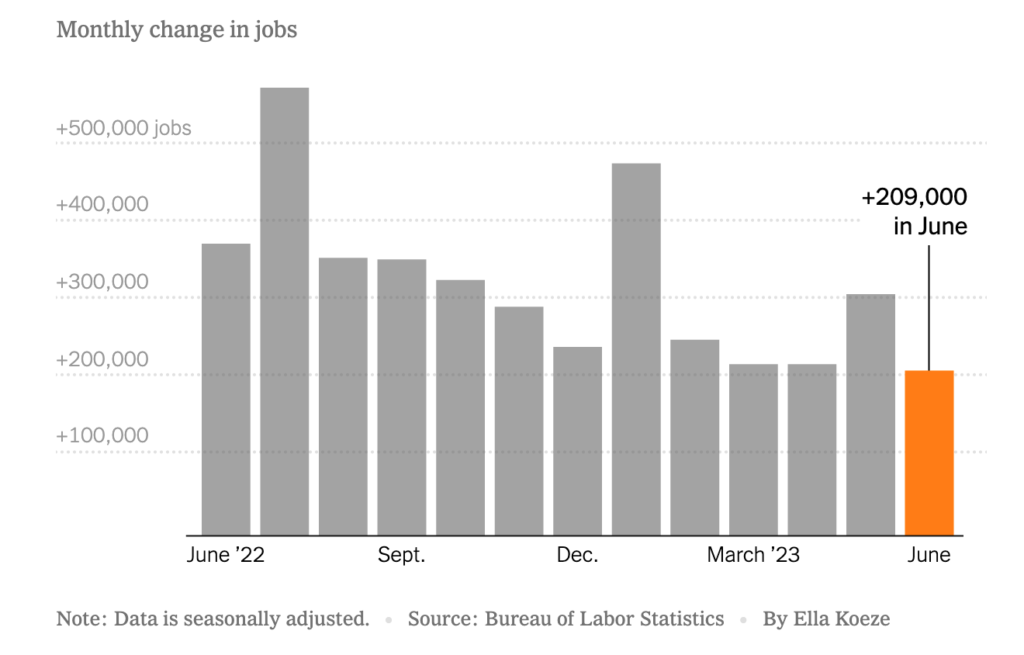

Supplementing the stellar CPI report, the June jobs report was showed 209,000 new jobs added during the month and an unemployment rate of 3.6%, which is near a 5-decade low. This represents a slight cooling for the jobs market, which is considered another positive reflection of the Fed’s interest rate hike regime taking hold.

The sum of this data implies that the Fed will continue its tightening policy by raising the federal funds rate another 0.25% at the July 26th meeting. There may still be one more increase before the end of the year, but that will depend on future economic data.

Why It Matters

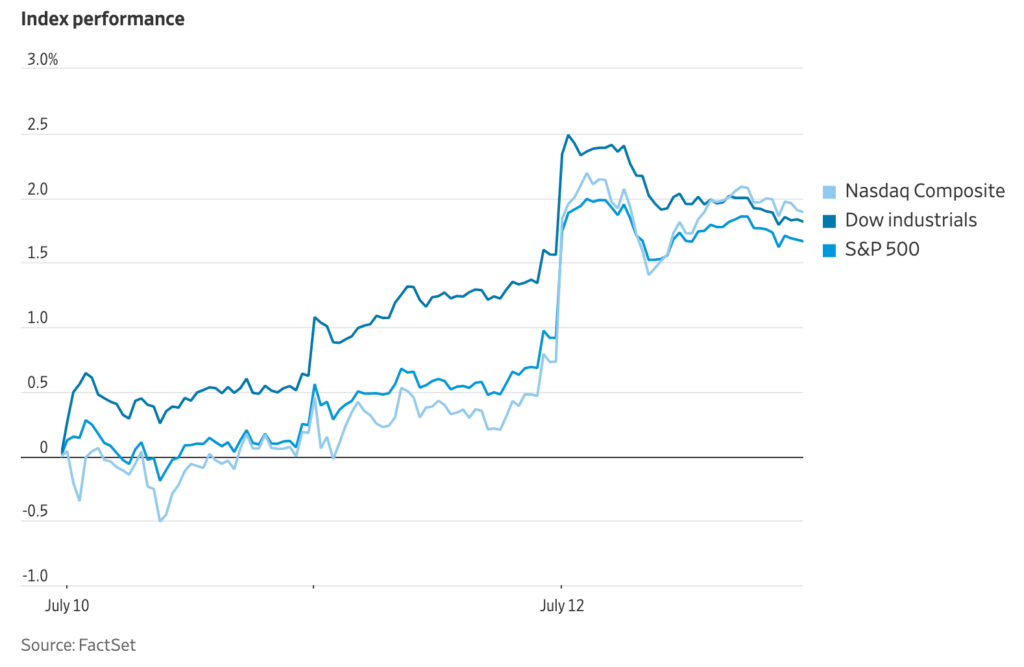

Financial markets responded favorably to the June CPI report by rallying across all the major indices. This reflects the general belief that the economy has nearly reached peak interest rates and that the fed has effectively navigated a ‘soft landing’ for the economy without leading into a recession.

What This Means For Real Estate

If we are able to avoid a recession and inflation has been brought back under control, it’s reasonable to assume that mortgage interest rates will also decline in the future. Even with the expectations of further short-term interest hikes, mortgage and refinance applications increased the week of July 14th following the CPI news. This shows consumer confidence growing after more than a year of high rates, seller lock-in, and lower real estate transaction volume.

Inverted Yields

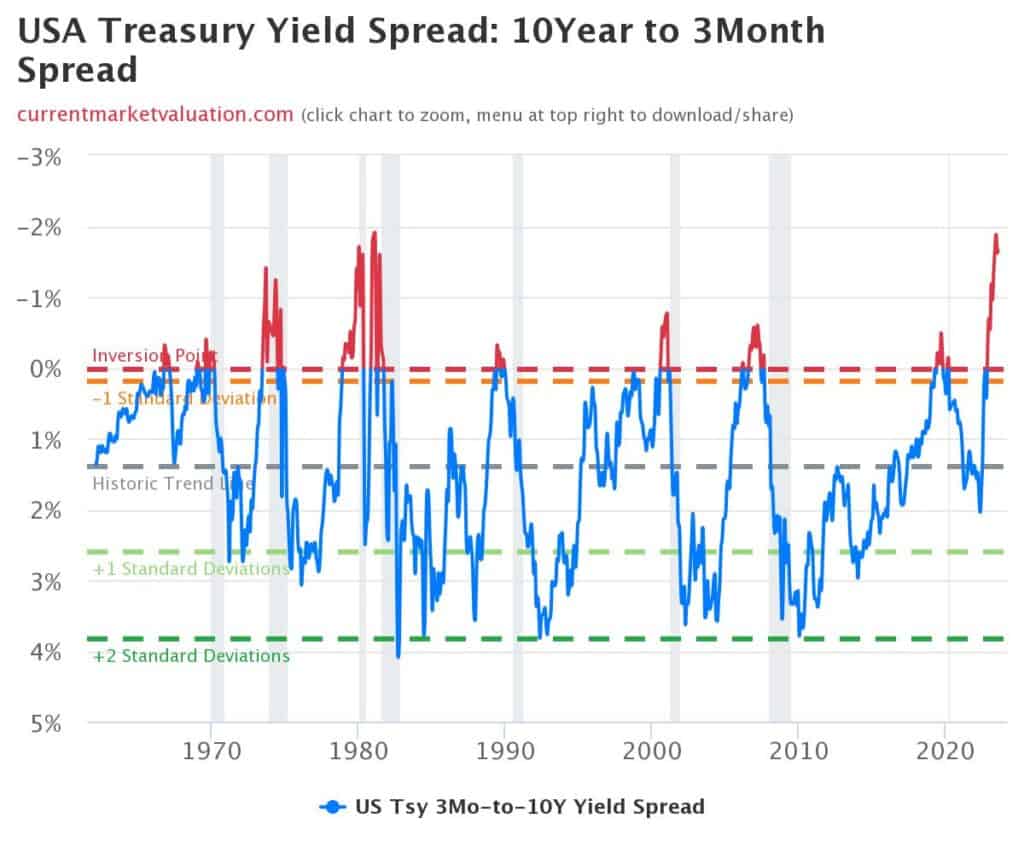

Now we get into some of the wonky and speculative details. A financial metric in the bond markets is known as the yield curve. This is the spread between short-term and longer-term treasury yields, or the interest rates paid on government bonds. In a typical market bond yields will be lower in the short-term (i.e. a 3 month maturity bond) and higher over longer periods (i.e. a 10 year bond). Investors will demand a higher rate of return to tie up their money for longer periods of time. This results in an upward sloping yield curve.

Once in a while, however, we find that the yield curve is inverted. This means that long-term interest rates for government bonds are LOWER than the short-term rates. This occurs when investors expect interest rates to fall in the future, so they lock-in bond returns at the higher current rate for a longer period of time (i.e. 10 years in this example). This reflects concern that the economy may dip into recession in the future which will lead the Federal Reserve to reduce interest rates to restart economic activity. This is what we’re seeing now; an inverted yield curve where short term bond yields are outpacing long-term yields.

Is This A Bad Thing?

What makes this potentially troubling is the fact that since World War II, every time the 3-month bond yield has been above the 10-year bond yield, the U.S. economy has slipped into a recession within an average of 12 months. The bond yield inverted last October, meaning that, if history holds, we may see a recession this fall. In the chart below, the gray vertical bars indicates recessionary periods following an inverted bond yield since 1970.

Now, as they always say with investing, “past performance is no guarantee of future returns”. This holds true of recessions as well. Conditions are different this time around including low unemployment, real wage growth, and declining inflation. But if history is to be our guide, there is a reasonable chance we don’t escape this cycle unscathed.

Conclusion

Recessions unevenly impact different segments of the economy. A short recession may be a good thing in that it will cool the economy further, reduce the risk of ongoing inflation, and lead to further interest rate reductions. Given this perspective, if you’re considering either buying or selling a home, the long-term outlook may favor an early move. As rates go down, more people enter the market increasing competition. By moving now, while inventory is tight you can begin building equity and refinance in a future period when rates decline.

Regardless of where you are in your real estate journey, I’ll continue to provide regular market updates, and don’t hesitate to reach out if I can answer any questions for you or your friends and family. Till next month!