What a whirlwind the past month has been! The inauguration of a new presidential administration has brought with it a flurry of Executive Orders (EOs) and threats of tariffs on trading partners. We’ve seen some surprising early year economic reports and overall the economic climate is one of significant uncertainty. Yet the beat goes on. My February 2025 Real Estate Market Update looks at the standard January economic reports but I’m also considering how administrative policy changes may impact real estate in the months ahead.

Current Market Conditions

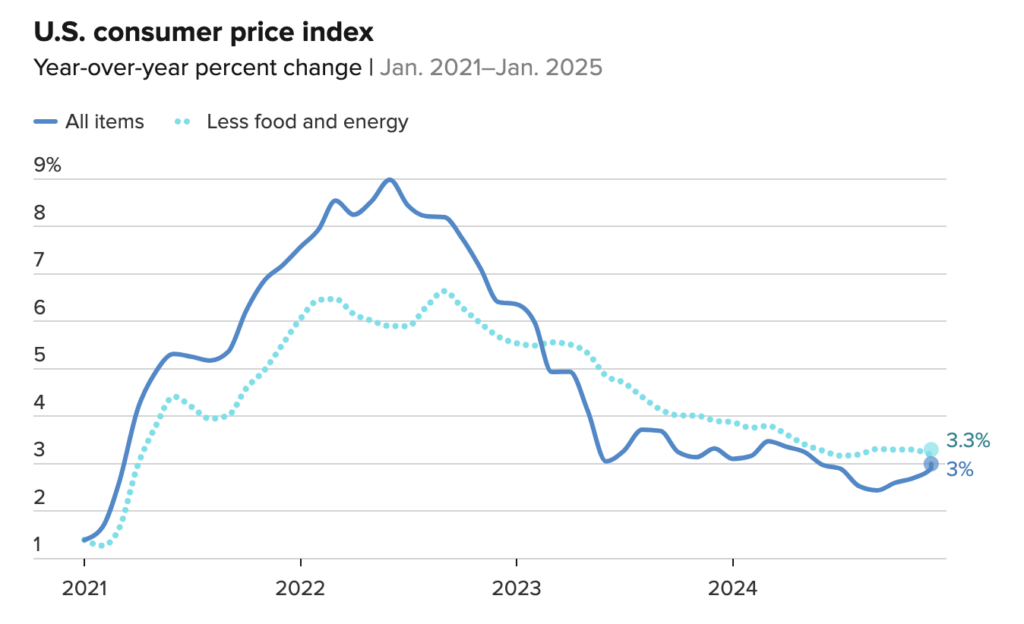

The January Consumer Price Index report showed inflation perking up a bit, giving the Federal Reserve more cover for holding rates for the time being. The annual inflation rate is now at 3%, about a full 100 basis points above the Federal reserve target of around 2%. Core inflation also remains elevated at 3.3% annually, above analyst expectations of 3.1%.

Shelter costs continue to be a problem for inflation, rising 0.4% on the month, 4.6% for the trailing 12 months, and accounting for about 30% of the entire increase. I’ve talked extensively about how housing costs continue to be the main driver of core inflation as higher mortgage rates push more Americans into a rental market in which vacancy rates are near record lows.

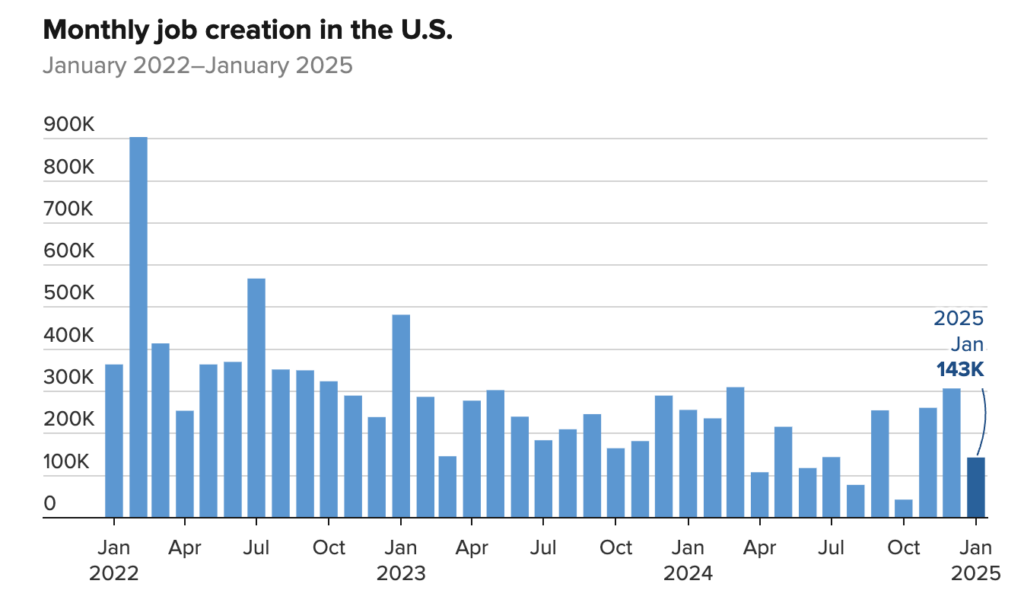

The relatively hot CPI report was followed by a comparatively weak jobs report. New job creation came in at just 143,000, down from the 2024 average of 166,000 each month. We’ve seen a steady decline in new jobs over the past few years, but even with slightly softer hiring, the unemployment rate dropped 0.1% to 4.0%.

On the brighter side, while job gains were muted, wages rose more than expected: Average hourly earnings increased 0.5% for the month and 4.1% from a year ago, compared with respective estimates for 0.3% and 3.7%. As this rate of wage growth is exceeding the inflation rate, workers are still seeing increased spending power which is partly responsible for the ongoing increase in inflation.

What’s Next for the Fed?

As of now, the Fed is still forecast to make two quarter-point rate cuts throughout 2025 but there remains a significant amount of uncertainty around these projections due to how trade and immigration policies may impact the economy.

There is another factor that will undoubtedly cast uncertainty over how the Federal Reserve will respond moving forward. President Trump signed an Executive Order placing many federal agencies, including the Federal Reserve, under Executive control. This action, while likely to face legal challenges, counters the century long belief that Federal agencies should be independent of political influence. Trump did, however, exclude the Federal Reserve’s rate setting authority from the EO. This means the Fed still retains some amount of independence, but it’s not clear how much or for how long.

Trump Administration Policy Moves

Additional EOs issued by President Trump in early 2025 are poised to significantly influence California’s real estate market. These orders aim to reduce housing costs, expedite housing development, and adjust trade policies. Each of these orders carry distinct implications for the state’s housing landscape.

Reducing Housing Costs

On January 20, 2025, President Trump signed an executive order titled “Delivering Emergency Price Relief for American Families and Defeating the Cost-of-Living Crisis.” This directive instructs federal agencies to identify and eliminate regulations that contribute to high housing costs, with the goal of making homeownership and renting more accessible. While deregulation will conceptually stimulate housing development, the executive order lacks specific policy actions, leaving its immediate impact on California’s housing market uncertain.

Expedited Development Approvals

Another executive order focuses on accelerating approvals for large-scale developments exceeding $1 billion. This initiative aims to reduce bureaucratic delays, potentially benefiting major housing projects in California. By streamlining the approval process, developers may find it more feasible to undertake substantial residential projects, potentially increasing housing supply in the state. That said, the inner east bay area has limited land for mega developments, so while this order may accelerate large housing projects throughout the country it’s unlikely to have a meaningful impact on our local real estate market in the near term.

Trade Policies and Construction Costs

The administration has reinstated significant tariffs, including a 25% tariff on imports from Mexico and Canada, with plans for higher tariffs on Chinese goods. These tariffs are expected to increase the cost of construction materials such as steel and lumber, leading to higher expenses for developers and potentially slowing the pace of new housing projects. This could exacerbate California’s existing housing shortage by making new construction more costly and less attractive to developers and buyers.

Labor and Immigration Policies

Stricter immigration policies, including mass deportations and enhanced border security measures, may lead to labor shortages in the construction industry. California’s housing sector, which relies heavily on immigrant labor, could face increased labor costs and project delays, further hindering efforts to address the housing crisis.

Environmental Regulation Rollbacks

The administration’s efforts to roll back environmental regulations aim to remove perceived obstacles to development. While this could lower compliance costs and expedite construction timelines, it raises concerns about long-term environmental impacts and sustainability, particularly in a state like California that prioritizes environmental protection.

Impact on the Real Estate Market

Particularly apropos to this market report, existing home sales dropped nearly 5% in January amid elevated mortgage interest rates. That said, the median home price was up nearly the same amount (5%) from the January period a year earlier. This is further indication that constrained housing inventory, regardless of borrowing costs, are keeping housing prices elevated.

So in totality, while the current economic landscape is comparatively stable, the future remains quite opaque. Inventory in the Berkeley and surrounding inner east bay area is still tight and mortgage interest rates have continued to hover around 7%. While the Fed is forecasted to reduce rates slightly through 2025, trade and fiscal policy could lead to increased inflation which would counter any tendencies to loosen the money supply. Federal policy to increase housing inventory will take years to unfold and it’s not clear how much it will impact supply and demand in our local market.

I expect that for the next 18 to 24 months we will be in for more or less what we’ve seen over the past year: Limited inventory, higher mortgage interest rates, and elevated home prices. This is generally a good climate for sellers, but for buyers with a 10-year plus investment horizon, the best time to buy a home is yesterday. Don’t let the day-to-day noise coming out of Washington dissuade you from achieving your home ownership dreams.

Conclusion

In summary, President Trump’s recent executive orders present a complex mix of potential benefits and challenges for California’s real estate market. While initiatives to reduce regulations and expedite development could enhance housing supply, increased construction costs due to tariffs, labor shortages from stricter immigration policies, and environmental concerns may offset these gains. Stakeholders in California’s housing market will need to navigate these multifaceted impacts carefully to effectively address the state’s ongoing housing challenges.

I continue to advise my clients to take a long-term view of the housing market and let your specific family circumstances dictate your buying and selling decisions. You can’t time the market and, given the ongoing uncertainty introduced by President Trump, you should continue to live your life and invest in a manner that matches your financial needs and risk tolerance. Please reach out to me to discuss the details of your personal situation and together we can find a path to reach your goals.