Welcome to my February 2024 Real Estate Market Update. The consumer and producer price index reports were released last week and both came in hotter than expected. In addition, the January jobs report also showed growth above expectations. While these data could be interpreted as a reversal of recent disinflationary trends, we also saw a weaker than expected retail sales report. In my market update last month I forecasted that the Fed would pause on rate cuts until the May meeting. Let’s see if any of the most recent economic data changes that expectation.

Current Market Conditions

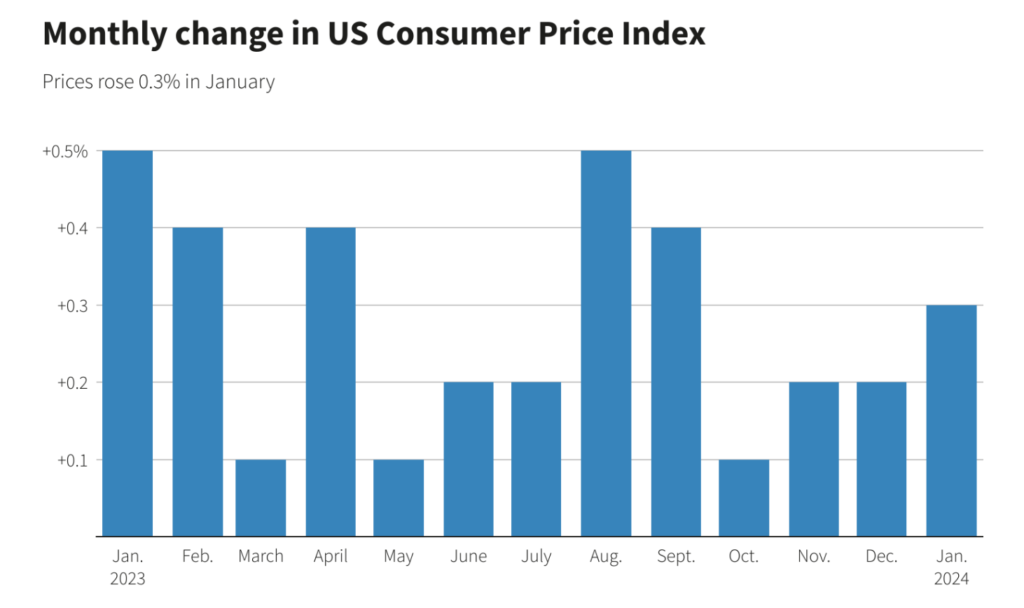

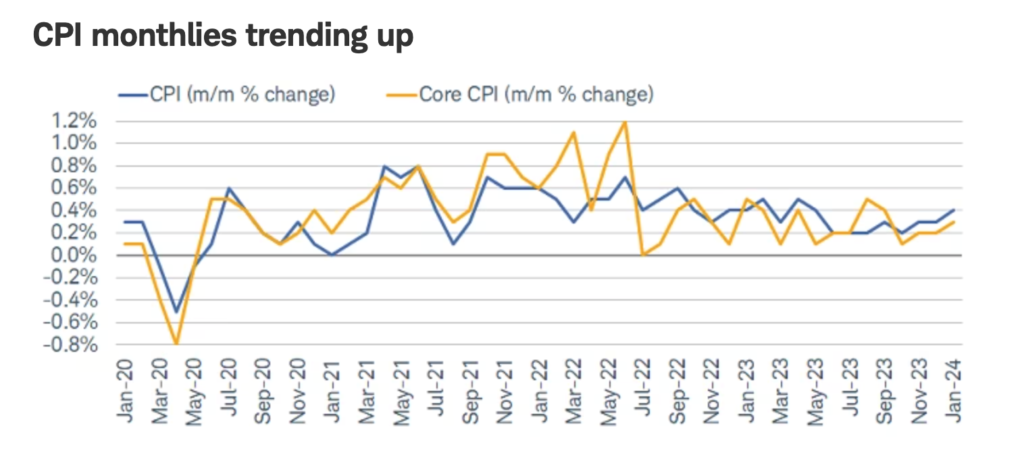

The January Consumer Price Index report revealed that the U.S. economy grew 0.3% over the prior month and 3.1% from the prior year. That is down from the 3.4% annual growth figure in December so the data is trending in the right direction, but remains above the 2% target set by the Federal Reserve board. Supply chains seem to be loosening as we’ve seen a decline in prices for things such as used cars, gasoline, and groceries. However, these price reductions have been offset by increases in service related goods including hotel rooms and medical care. It’s typical for service related costs to decline more slowly than prices for physical products, giving the Fed another element to consider prior to reducing rates later this year.

The other side of pricing data is the cost of raw materials used by companies to create the products they sell to consumers. This is known as the Producer Price Index, and similar to the CPI report, the January PPI report showed an increase of 0.3% over the prior month. This was a surprise to analysts after the PPI declined by an adjusted 0.1% the prior month. Tight labor markets can contribute to producer prices as employee salaries often make up a material portion of overall product costs.

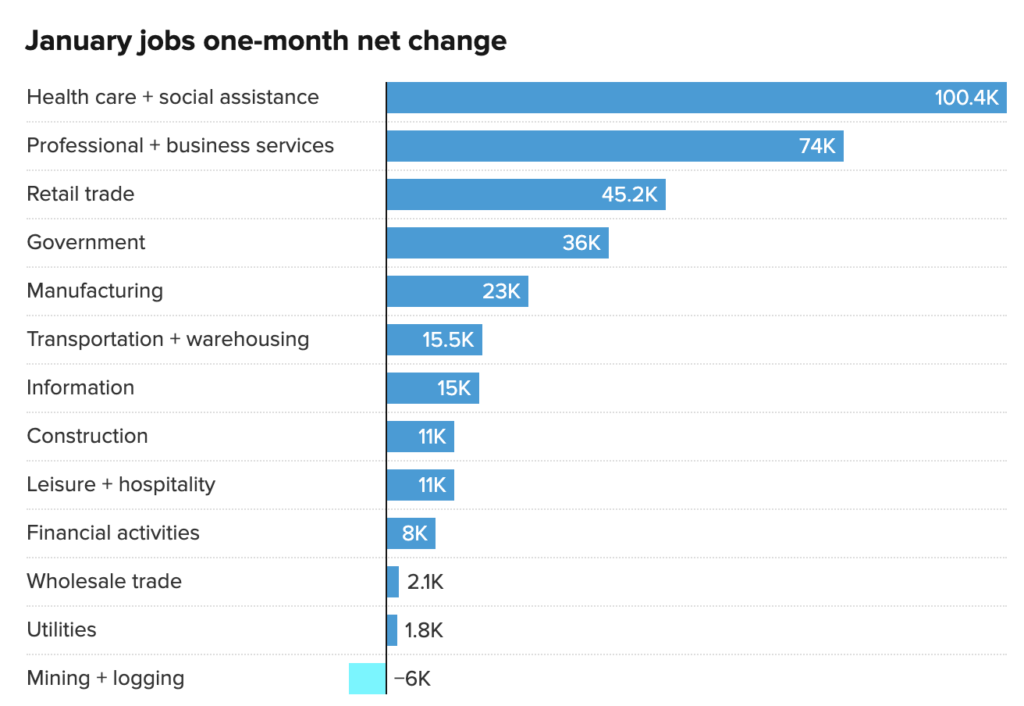

Conversely, the January jobs report confounded forecasters by adding 353,000 new jobs, far more than expected. Strong job and wage growth are often factors that favor inflation as workers have more disposable income to spend which keeps prices for goods and services elevated.

Finally, and as an upside surprise from an inflation perspective, retail sales dropped a whopping 0.8% in January after rising 0.4% in December. While a decrease following the holiday shopping season was expected, the scale of the decline was a big surprise. This means that consumer spending fell sharply which may provide an indication of a possible economic contraction and could give the Fed support to go ahead with an interest rate reduction in the next few months.

The Global Picture

While not directly correlated with the U.S. Economy, the global market has been seeing signs of weakness across China, Europe, and Japan. Eurozone growth is now forecast at a modest 0.8% for 2024, down from a 1.2% growth forecast this past fall.

The International Monetary Fund (IMF) has forecast global growth at 2.9% for 2024, just down a tick from 3% in 2023. While not overly concerning in itself, the chance for economic disruptions due to geopolitical conflict in the middle-east or Ukraine, could lead to further supply chain disruptions and geoeconomic fragmentation.

Given global economic interdependence, in-spite of growing protectionist policies around the world, declining economic growth outside the U.S. could lead to weaker trade exports which may have a longer-term impact on domestic economic growth. These are additional head winds that the Federal Reserve will need to take into consideration when deciding on future interest rate cuts.

The Impact On Real Estate

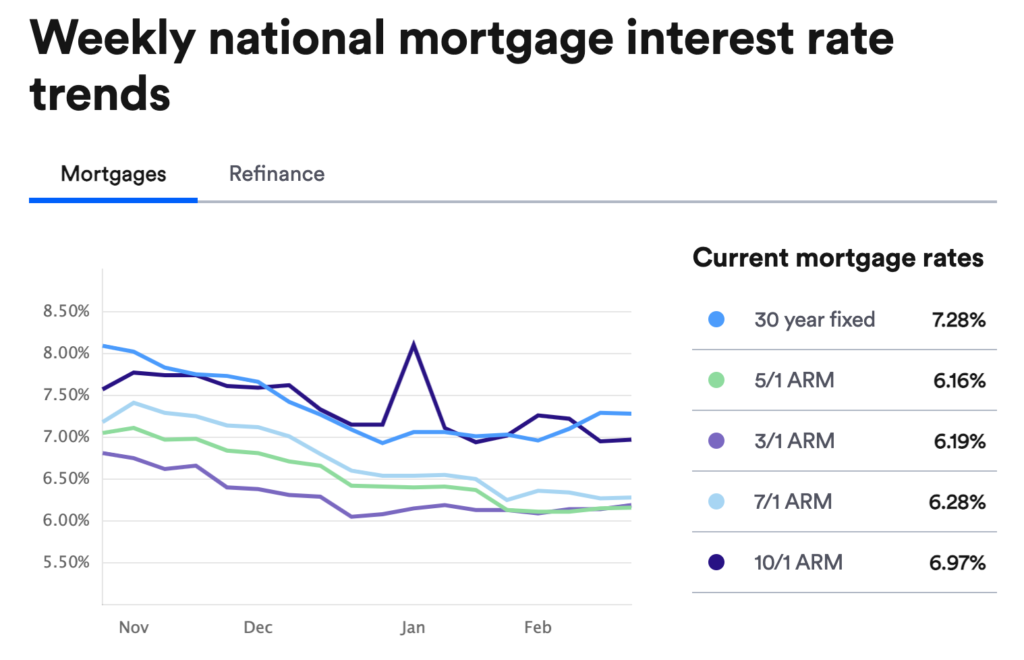

The short version is that the preponderance of optimistic economic reports in recent weeks have dampened expectations that the Federal Reserve will reduce the Prime Rate at its upcoming March policy meeting. We’ve already seen mortgage interest rates averages climb back to above 7% in the recent weeks. And somewhat surprisingly, the stock market just set a new record, led by Nvidia and optimism around global demand for artificial intelligence technologies.

While the U.S. economy has been unexpectedly resilient over the past couple of years, I still expect to see some cooling in the months ahead, and maintain my forecast that the Fed will reduce rates several times throughout 2024, starting with a modest cut at their May policy meeting.

Once that happens, we will see mortgage interest rates decline, more buyers enter the market, competition for limited housing inventory increase, and higher home purchase prices. I’m advising my buyer clients to consider purchasing ahead of this change by opting for an adjustable rate mortgage (ARM). I’m seeing 5-year ARM loans close to 6% in recent days:

If you believe that interest rates will decline below 6% in the next 5 years, then taking out an adjustable rate loan (which may offer interest only payments) and then refinancing in the next few years as rates drop, may be something to consider. If you need a referral to a great mortgage broker, just contact me for details.

For sellers, my advice remains the same as always: You can’t time the market. Let your personal circumstances dictate your selling strategy. I’d love an opportunity to meet with you to discuss the specifics of your real estate plans to help you come to a conclusion that is best for your family and financial situation.

Conclusion

There will always be uncertainty when it comes to financial markets. While I believe we are directionally headed toward a lower mortgage interest rate regime which will improve buyer purchasing power and increase the number of listings on the market, external factors can always derail those predictions. Geopolitical events have a way of surprising markets, and our own domestic political situation is certainly subject to change in ways that can not be obviously anticipated.

Real estate is a long-term game and has historically delivered excellent investment returns over other asset classes. Life goes on and people need to buy and sell homes, so don’t let the day-to-day activity of financial markets obscure your wealth building goals. I can help you navigate the complexities and offer some objectivity on how your choices may play out in the years ahead. Please reach out to talk about your specific needs, and I’ll keep doing my best to offer information, advice, and when needed, a warm embrace.