We’ve seen a lot of up and downs in the real estate market over the past few years, and with a new administration taking office in January, it looks like uncertainty will remain the name of the game heading into next year. In my December 2024 real estate market update I’m unpacking some November economic data and recent Fed moves to divine what we might expect in real estate in 2025.

Current Market Conditions

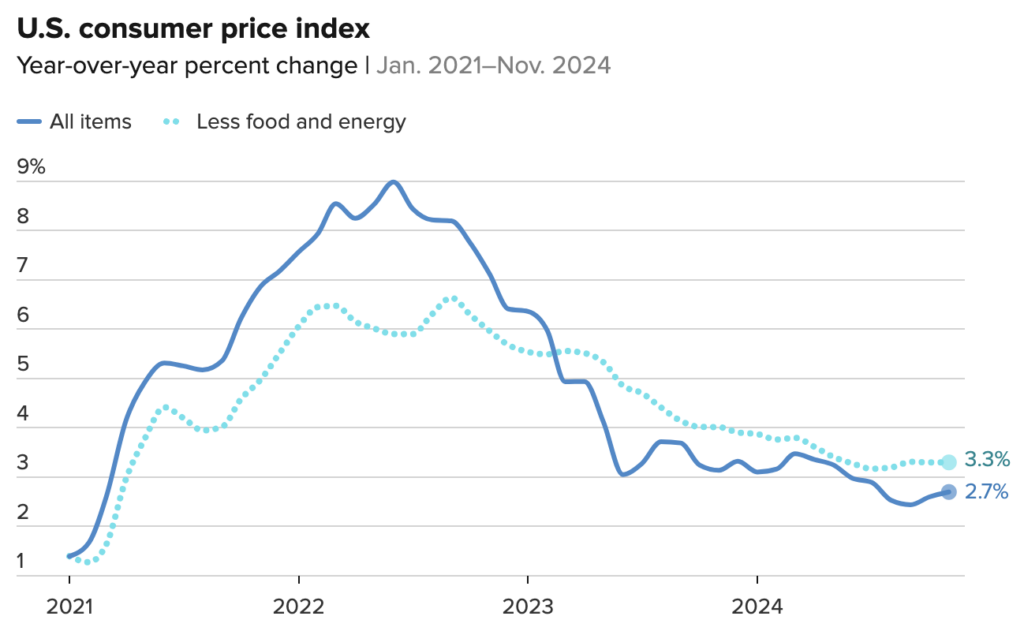

We have a set of new data to sift though starting with the November Consumer Price Index report. As expected, year-over-year inflation increased by a modest 0.3% in November to total 2.7% for the trailing 12 months. Core inflation was up 3.3% with shelter costs up 0.3% from the prior month and 4.7% since last November. Readers of my market reports will note that shelter costs have been an ongoing contributor to stubborn inflation and that trends appears poised to continue for the foreseeable future.

The November Jobs report was a bit of a mixed bag with 227,000 new jobs reported. While this number was considerably higher than the prior month, the growth was expected following an October strike by Boeing workers as well as impacts from Hurricane Milton which disproportionally impacted job growth in that period. Countering the strong job growth data was an increase in the unemployment rate to 4.2%. Wage growth was also up 4% from the prior year, so workers real wages are continuing to outpace inflation.

Perhaps unsurprisingly, consumer confidence increased rather abruptly following the early November presidential election amid optimism over the labor market, expectations for lower inflation and higher stock prices over the next year. This optimism could have a dampening impact on future Fed rate decisions. Increased consumers spending due to economic optimism has the chance of leading to higher prices.

What’s Next for the Fed?

At the final policy meeting for 2024, the Federal Reserve cut the prime rate by an expected 25 basis points. This was the third rate cut of the year for a total of 1% during 2024. More important than the cut itself is what the Fed is forecasting for 2025. In a statement following the December meeting, the Fed projected just 2 rate cuts in the coming year, citing ongoing inflation concerns amid a strong jobs market and healthy consumer spending. Economic analysts had been expecting 3 cuts in 2025 and the announcement saw the stock market drop and 10 year treasury bound yields rise.

The big question that the Fed will have to content with after the Trump administration is sworn in at the end of January, is how proposed tariffs will impact prices. If Trump follows through on his stated goal to increase tariffs by 25% on Canada and Mexico along with much larger increases on imported Chinese goods, it is expected that prices will rise as U.S. firms pass along the higher import costs to consumers. This could prompt the Fed to forgo further rate cuts, or possibly even raise rates if inflation begins to creep up to 3% or more.

Impact on the Real Estate Market

Nationally, existing home sales rose 4.8% in November, marking a significant rebound. The median home sale price also climbed 6% year-over-year, showing that buyer demand remains steady even in the face of high prices.

Closer to home, Berkeley remains one of the most competitive markets in the Bay Area. At $1.4 million as of November, Berkeley’s median sale price reflects a 7.5% year-over-year increase. Homes are selling quickly, often in under 15 days, with many properties receiving multiple offers. Active listings saw a modest rise, with 118 properties available at the end of November, giving buyers a bit more choice heading into the new year.

That said, mortgage interest rates crept up over the past week following the Fed announcement of fewer rate cuts in 2025. The 30 year fixed mortgage is now averaging nearly 6.75%, up nearly 20 basis points in the past week. This is making it more expensive for buyer, while also reinforcing the Golden Handcuff lock-in effect for sellers.

Conclusion

Overall the economy remains healthy with modest inflation, strong job and wage growth, modest unemployment, and strong consumer confidence. This is not a recipe for dramatic rate cuts in the foreseeable future. In addition, the possibility of a high tariff regime in 2025 along with proposed tax cuts could contribute to ongoing inflationary pressures and lead to higher interest rates in the long-term. Both buyers and sellers should be prepared for more expensive borrowing costs moving forward. This doesn’t mean that you should change your plans to transact in real estate, but rather factor in these costs when considering your next move.

I would love the opportunity to talk with you about your 2025 real estate journey and help you devise a strategy that makes the most sense for your specific family and financial situation. With smart targeting and some advanced planning, you can still make the best of an uncertain market.

Regardless of your real estate plans, thank you for your ongoing support and here’s wishing you and your family the best in 2025!