Summer is winding down and we’ve seen some clear signs that inflation is under control. Unfortunately, it the job market is not looking as resilient as it originally appeared earlier in the year. In my August 2024 real estate market update, I examine the most recent economic data and look to the fall selling season to help advise you on how to frame buying or selling a home in Berkeley and the surrounding area.

Current Market Conditions

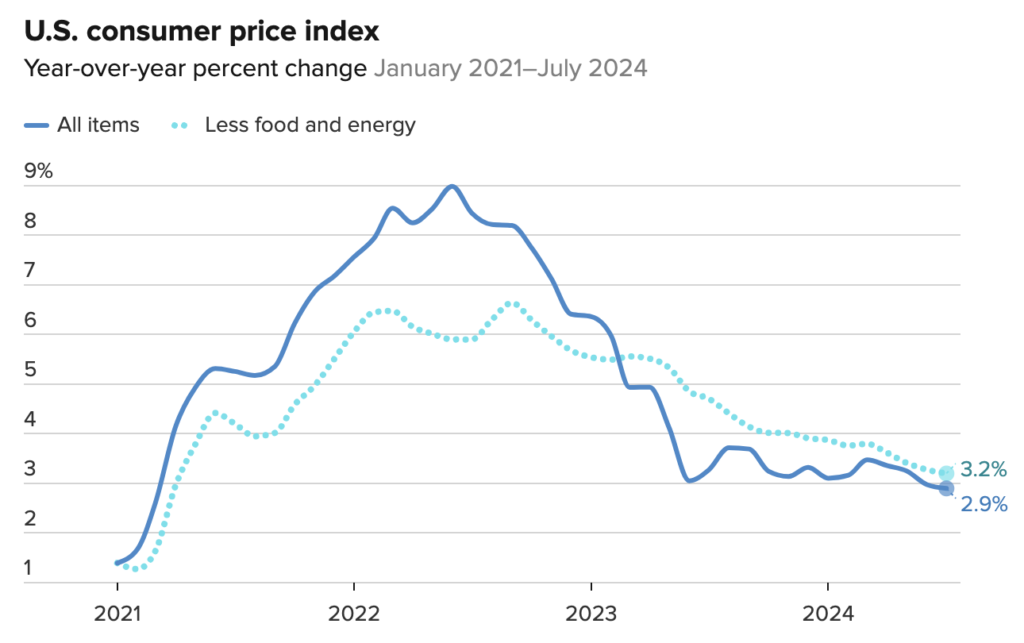

Per usual, I like to start by covering the most recent economic reports on consumer spending and jobs. The July Consumer Price Index report came out earlier this month and the headline is that inflation dropped to 2.9% with the core rate slightly higher at 3.2%. These are the lowest levels since 2021. Shelter expenses remain stubborn, increasing by 0.4% and accounting for 90% of the total increase.

Also, a Labor Department report from August 13th showed that producer prices, a proxy for wholesale inflation, rose just 0.1% in July and were up 2.2% year over year. These numbers were below expectations and are another encouraging sign that inflation is nearly in check.

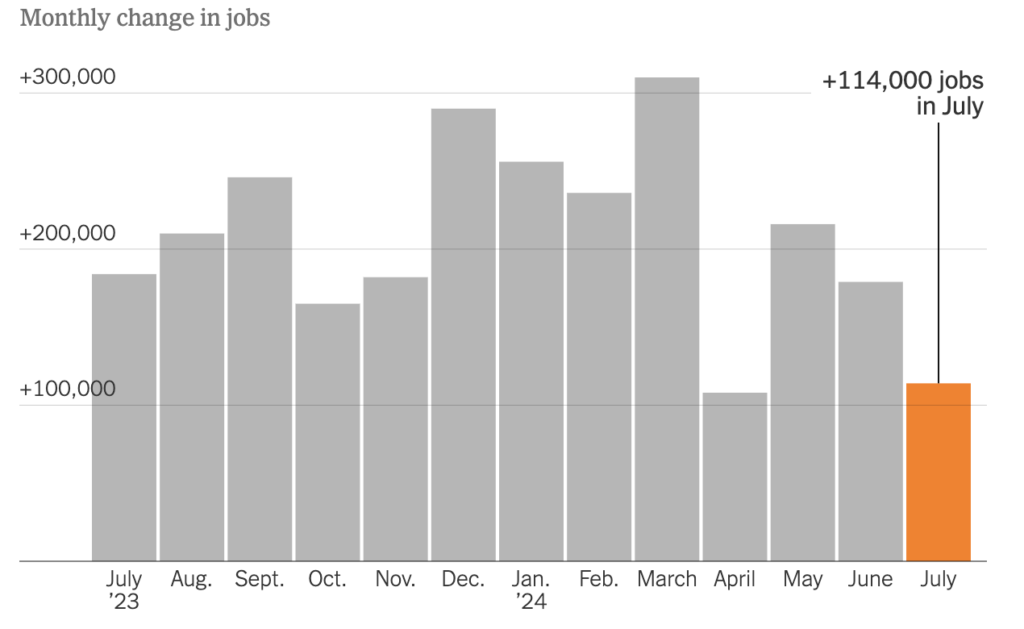

Perhaps more important than consumer or producer prices is the July jobs report which came in well below expectations. The economy added just 114,000 jobs while the unemployment rate unexpectedly jumped to 4.3%. This report was both surprising and somewhat worrying. Economists have been heavily focused on prices over the past couple of years as inflation was considered the top priority to address. It now appears that the Fed may have kept interest rates too high for too long and that is beginning to impact the jobs market which could imply a recession in the months ahead.

Also, another recent report revised job growth from March 2023 to March 2024 downward by 818,000 jobs. This is fewer than 70,000 jobs monthly and it isn’t terribly unusual to see revised reports after the fact, but taken with the July report, the job market does appear to be slowing.

The Fed’s Impact on Mortgage Rates

At the onset of the pandemic in 2020 and 2021, the Federal Reserve aimed to stimulate the economy by buying mortgage-backed securities (MBS) on a massive scale as part of its quantitative easing program. This effectively funneled cash to homebuyers, leading the Fed’s MBS holdings to grow from $1.4 trillion in March 2020 to a peak of $2.7 trillion.

However, in its fight against inflation, the Fed reversed this strategy, reducing its MBS holdings by about $400 billion so far.

During the same period in 2021, consumers rapidly accumulated savings, which buoyed bank deposits. Banks, needing to put this excess cash to use, increased their mortgage lending and MBS purchases. But as interest rates rose, depositors began withdrawing funds in favor of higher-yield options like Treasury bills and money market mutual funds.

As monetary policy shifted, both banks and the Fed reduced their mortgage holdings, which led to rising mortgage rates and a widening mortgage spread. This provides more detail on the significant impact that monetary policy has had on mortgage rates.

What’s Next?

Looking at this data in aggregate, there are clear signs that inflation is approaching the 2% annual target set by the Fed while job and wage growth is slowing. The conversation has now shifted from IF the Fed will decrease rates to HOW MUCH they will drop rates. The Fed policy board next meets on September 17-18 and the big intrigue is now whether the Fed will decrease rates 0.25% or a larger 0.50% drop.

The Impact On Real Estate

Housing costs remain stubborn given a lack of available units, and the high interest rate regime we’ve seen over the past couple of years has further contributed to this trend. With bond yields dropping and a clear line of sight to a series of Fed interest rate decreases, the mortgage markets have responded accordingly.

Mortgage interest rates finally dropped below 6% (on average across the country) which is a good sign for both buyers and sellers. It’s good for buyers as borrowing costs are declining which improves purchasing power. It’s good for sellers as lower rates increase buyer demand, but also make it easier for sellers to give up their ultra low refinance rates when moving to a new home. Note that jumbo loans, which are commonly required for home purchase in the Bay Area, tend to be offered at slightly higher interest rates.

An Elephant In The Room

A not so surprising variable in these analyses is the outcome of the presidential election on November 5th.

Donald Trump has indicated a desire to raise tariffs on foreign imports (with a special focus on Chinese goods) which could lead to renewed inflation.

Kamala Harris, on the other hand, has discussed ways of making home ownership more affordable including cutting regulations that slow down housing construction, and possibly offering first time home buyers a $25,000 tax credit for down payment assistance. This could lead to further home price increases as first time buyer bid up property values with their newly found cash.

But beyond the specific economic policies of either candidate is the fact of the election itself. One thing we can be sure of is that the election is going to be close. Very close. In fact, it may be weeks, or even months before we know the final results. There could possibly be legal challenges and if the events of January 6th, 2021 are any guide, we may experience political violence.

All of this is to say that we are in for a period of uncertainty. Markets do not like uncertainty. Consequently, I suspect that property transactions will dramatically decrease from November through early January. While this could create opportunities for select purchasers, fewer buyers is generally not a good sign for home sellers.

Conclusion

This is a lot of mixed information and the conclusions are also somewhat contradictory. Inflation appears to be in check, but the economy may be faltering. Mortgage interest rates are dropping and that bodes well for the fall market, but the upcoming election may throw a wrench in the plans of many home buyers and sellers.

All that said, my advice remains the same. Don’t try to time the market. Look for opportunities that may come up and be prepared to move quickly. Circumstances will likely change so remain flexible. And ultimately, do what makes the most sense for your family and personal financial situation. Don’t let the news of the day or fluctuations in the market dictate your plans. Work with a great agent, develop a rational strategy, and then execute.

If you need help working through this process, I’d love to hear from you. You’re never in this journey alone, so let me be your guide and partner.