Welcome to my March 2024 Real Estate Market Update. The Federal Reserve board held their open market meeting this week to discuss possible interest rate modifications and chose to keep rates unchanged for the time being. However, they also maintained their forecast for 3 interest rate cuts throughout 2024.

It’s also time to review the February Consumer Price Index, the Producer Price Index, a new jobs report, as well as other monetary moves by the Fed that may have impacts on mortgage interest rates and the local real estate market. There’s a lot of juicy data to dig into, so let’s go!

Current Market Conditions

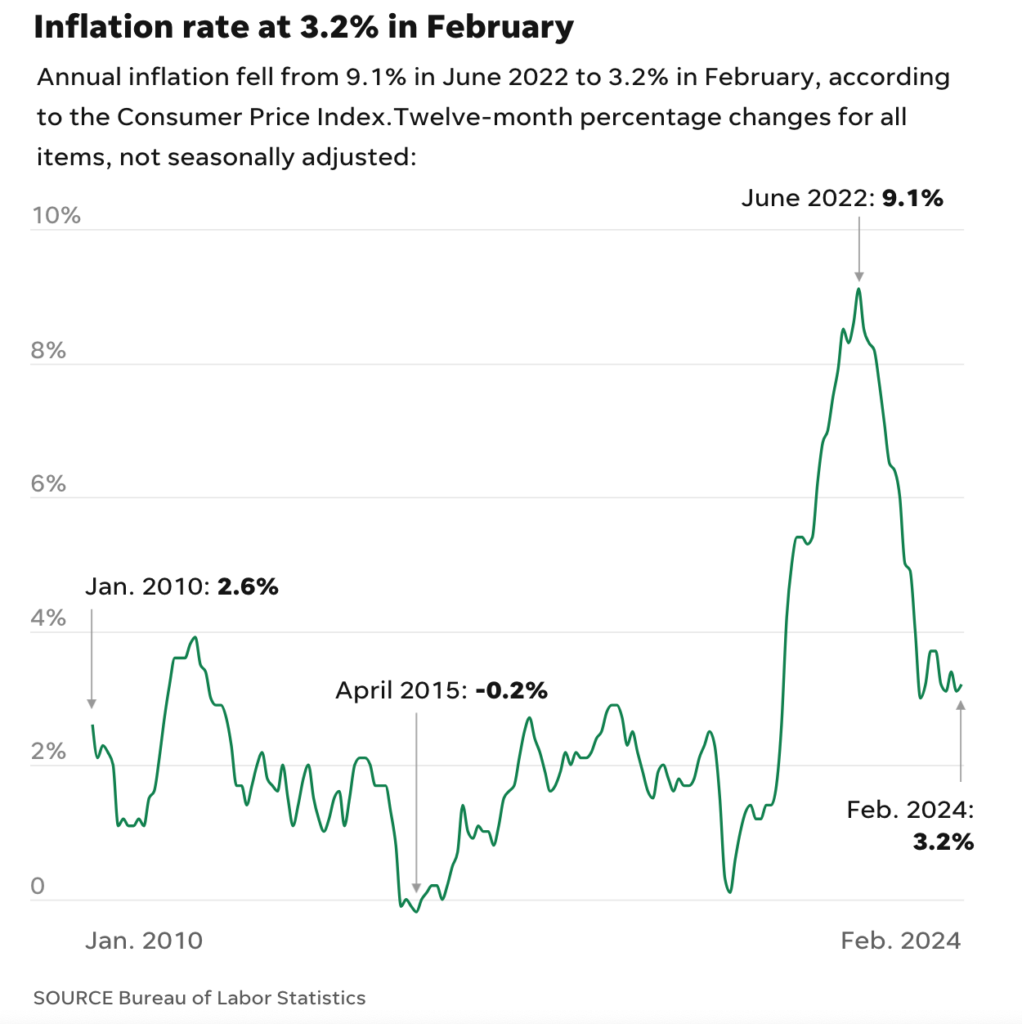

The February CPI came in high for the second month in a row. Consumer prices rose 0.4% in February and the core index (excluding food and energy) was up 0.4%. The core index has generally been coming in a bit higher than the general CPI so this was seen by analysts as a moderating factor. Also notable was that the 12-month trailing inflation rate was 3.2%. The core index was up 3.8% which was a reduction from 3.9% the prior month and the lowest increase since 2021. That said, the CPI excluding food and energy has risen at a 4.2% annual rate over the last three months, far above the 2.6% notched this past summer.

Retail spending bounced back slightly in February from a sharp pullback at the start of the year. The Commerce Department said that retail sales rose 0.6% last month. But January’s drop was worse than initially thought: Retail sales fell 1.1%, not the 0.8% first estimated. This was largely attributed to cold weather across the country that kept people away from shopping. It’s also noteworthy that January was the fourth straight month with a negative revision to earlier months’ data.

Moving to the supply side, the Producer Price Index rose 1.2% in February. That was mainly driven by surging energy and food prices. But even excluding those, the PPI rose an uncomfortably high 0.4%. Goods prices excluding food and energy rose 0.3% for the second straight month. It was rising 0.1% a month in the final months of 2023. Clearly the ‘last mile’ of inflation is proving challenging to stamp out.

Moving on to jobs data, the February report showed 275,000 new hires even in the face of other uncertain economic data. However, payroll numbers for both December and January were revised downward and the overall unemployment rate rose from 3.7% to 3.9%, the highest in 2 years. While the economy is generally considered at nearly full employment, this rise in unemployment does imply some economic weakening which seems to have partly informed the Fed decision on future interest rate decreases.

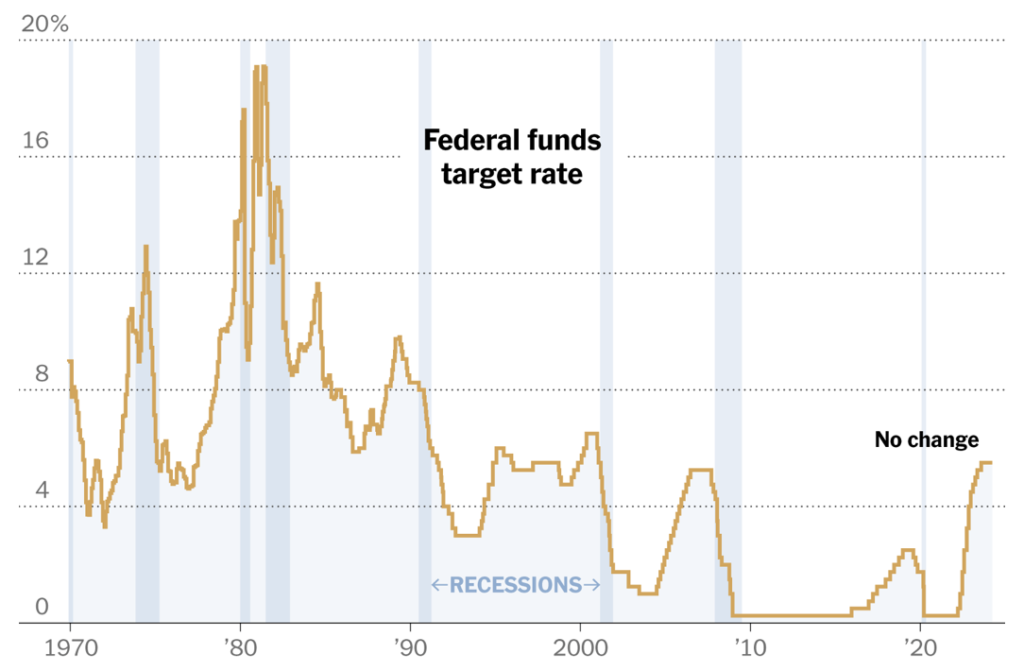

As I mentioned at the top of the article, the Federal Funds rate was left unchanged. It remains useful to look at the rate over the past 50 years to keep things in context:

So the Fed kept rates unchanged but reaffirmed their intent to lower rates 3 times throughout the year. My original forecast in January was that the Fed would begin lowering rates in May. But, due to ongoing inflation, the consensus is looking like that first rate reduction will probably be in June. Also, I expect that the first rate reduction will be modest, most likely just 0.25%. Of course we could get more encouraging economic data over the next couple of months that could change things.

The Impact On Real Estate

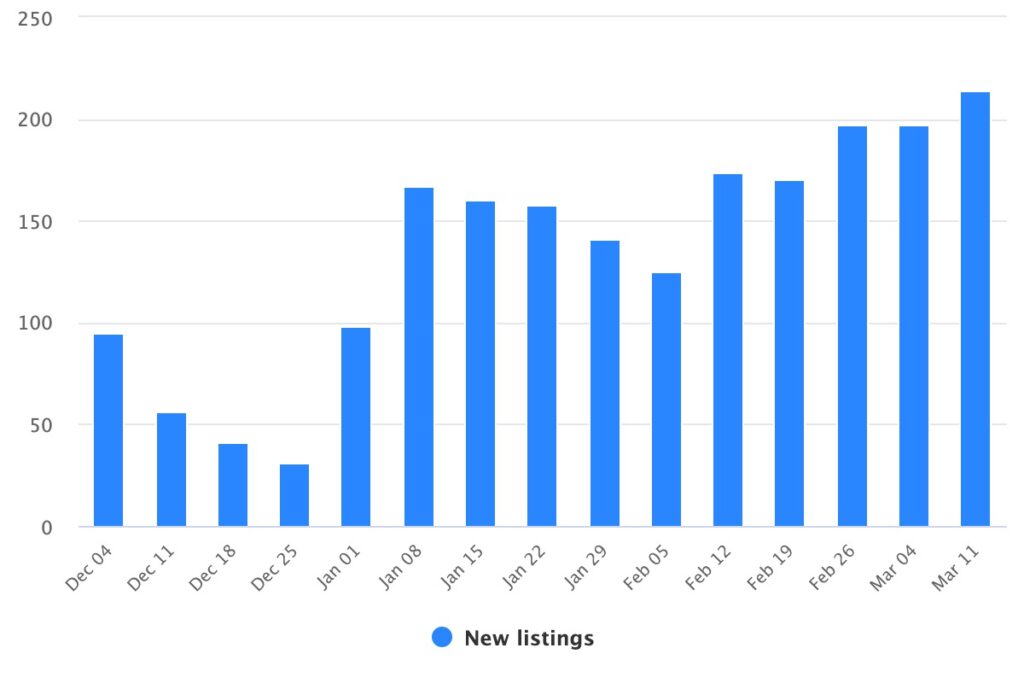

Real estate investing remains a long game. The month-to-month variances of the economy and interest rates don’t have a major impact on the decision to buy or sell a home. I’m seeing healthy transaction activity in the Berkeley real estate market as well as adjacent areas. We’re just now entering the heart of the spring selling season and we are seeing a predictable increase in home inventory.

New inventory is now up more than 8% month-over-month while home sales are up 36% from January. I expect this trend to continue over the next 8 to 10 weeks.

Now is the best time for homeowners looking to sell to prepare their homes for market. I can generally bring a property to market in 4 to 6 weeks which still gives you time to catch the spring transaction wave.

For buyers, more inventory increases your purchase options but also tends to come with increased competition. Demand for houses at the lower end of the market is nearly always high, regardless of inventory, so don’t let this deter you. As I always say, yesterday is the best time to buy a house, but today is the next best option. As long as you have a 5+ year time horizon the chances are very good you will see property appreciation at levels that match or exceed the stock market, making real estate a great long-term investment.

Conclusion

Fed watchers love to follow every comment and glance of not only Federal Reserve chairman Jerome Powell, but those of the other regional governors as well. Each statement that is issued from the Fed is analyzed with a fine tooth comb looking for clues of possible future moves that may inform investment decisions. Yet regardless of which way the economic winds blow in the next year, home ownership remains a beneficial objective for nearly every American.

I am always here to inform, advise, consult, and most importantly, listen. I want to hear from you to understand your questions and your fears. I do 40 to 50 transactions most years and have tons of iterative experience to inform my perspective on the real estate market. My ultimate goal is to become your trusted advisor for the remainder of your real estate life. Never hesitate to contact me about any subject, and not just real estate. I’m always happy to talk schools, remodeling, sustainability, historic preservation, home decorating, fashion, or even local politics.

Just reach out and we can schedule a time to chat. I hope to hear from you soon!