The turn of the calendar has brought renewed optimism to financial markets and I personally have seen a meaningful increase in activity in the Berkeley real estate market. We’ve all been waiting for signs that interest rates will decline, unlocking new property inventory and bringing greater affordability to the home purchasing process, which leads me to my January 2024 real estate market update.

There are indications that we’ve passed ‘peak interest rates’ from the latest inflation fighting cycle, but current economic data still paints a murky picture on the timing of rate decreases. I’m going to review the most recent CPI and jobs reports as well as the just released Q4 GDP report and then look at what we’re seeing with mortgage interest rates and activity in the local real estate market.

Current Market Conditions

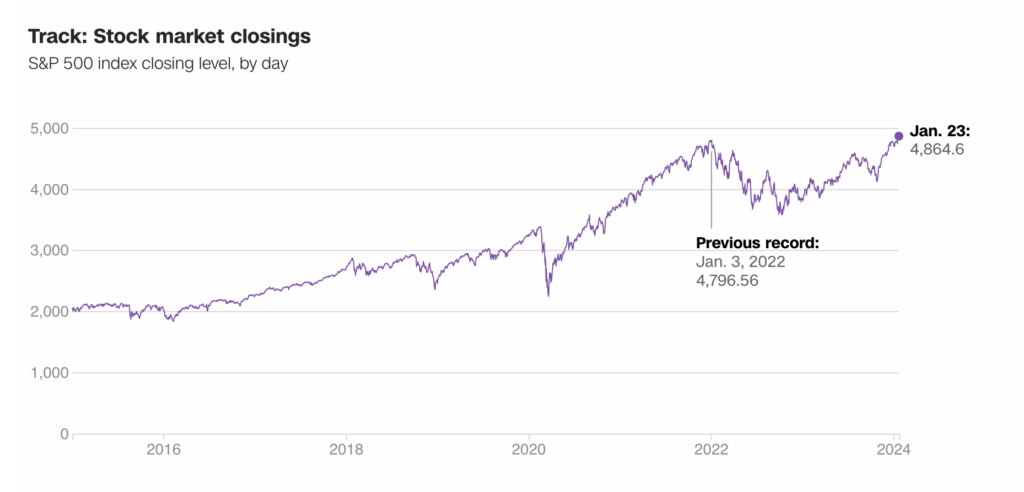

We saw a new record high for the stock market last week, based in part of what have been perceived as directionally positive economic reports. Part of the rally may be due to the Federal Reserve forecasting up to 3 interest rate cuts in 2024, though there is other data which has impacted the market.

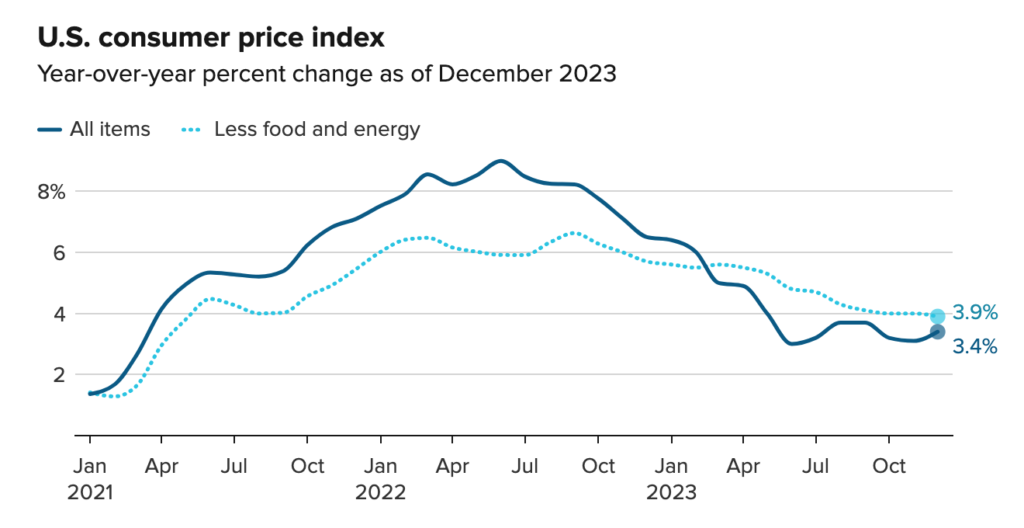

The December 2023 Consumer Price Index report was something of a mixed bag. Inflation increased 0.3% in December and 3.4% from the prior year which were both slightly higher than anticipated. The core inflation rate was also up 3.9% from the prior year, just above predictions and mostly due to increases in shelter costs.

On an annual basis, shelter costs have risen 6.2% which accounts for nearly two-thirds of the entire inflation increase. Clearly housing (rents and rent equivalents for owners) are one of the key drivers of stubborn inflation. It’s worth noting that housing cost data lags the economy as renters will often sign long-term (annual) leases, so the data isn’t updated until leases renew.

Another important set of data from December is the jobs report. While December jobs growth exceed expectations, downward revisions of October and November jobs data resulted in what is effectively a wash from the prior month. These adjustments are common as more detail becomes available in the 30-60 days following each monthly jobs report.

Looking at jobs throughout the entire year yields a more insightful view. The economy added 2.7 million jobs in 2023, down from 4.8 million in 2022, a decline of nearly 45%. This looks a lot like the ‘soft landing’ the Fed has been aiming for – gradually slowing economic growth while avoiding mass layoffs or a recession (defined as at least 2 fiscal quarters of negative economic growth).

Labor participation waned throughout 2023 (fewer people looking for jobs), which could lead to wage growth pressure. This might possibly lead the Fed to enact interest rate reductions later rather than sooner.

Finally, the Q4 GDP report was just released this morning and surprised in a number of areas. Fourth quarter growth came in at 3.3% which was well beyond expectation, but quarter-to-quarter price increases came in at 2% – exactly in line with the Fed’s target inflation rate.

Fed leaders appear open to rate cuts in the not-too-distant future but are also making it clear that they need to see more decisive evidence that the recent good news on inflation will continue. For Fed governors to seriously consider cutting rates as early as March, they will be looking for signs of soft inflation which will begin to show up in data released throughout February. If I had to place a bet today, I would forecast that the Fed will hold interest rates steady at the March meeting and then announce a rate cut in May.

The Impact On Real Estate

As we discussed, much of recent inflationary pressure is from shelter costs. However, there is a limited amount that the Federal Reserve can do to address this key segment of the economy. There is irony in that one of the key economic factors keeping shelter costs high is a lack of affordable housing. Part of this is due to high mortgage interest rates, so in trying to cool the overall economy by making borrowing costs higher, the Fed is actually contributing to ongoing inflationary activity in the housing sector.

Regardless, financial markets seem convinced that the Fed Funds rate will be cut sometime in 2024 and mortgage interest rates have fallen accordingly. As recently as this past October we saw mortgage interest rates peak close to 8%. For the week ending January 18th, the 30-year fixed mortgage interest averaged 6.6%. Mortgage rate reductions are clearly leading to greater buyer demand with mortgage applications up 3.7% over the past week.

Lower rates are having the effect of both increasing demand from buyers who have been waiting for greater affordability while simultaneously unlocking home inventory. Many sellers who refinanced at sub-3% rates a few years ago are now looking to let go of those ultra-cheap mortgages and let their life circumstances dictate their real estate choices.

Anecdotally I’ve been seeing both increased demand from buyers as well as more sellers interested in putting their properties on the market. While more inventory is certainly a welcome sign, an influx of buyers is going to keep prices elevated. My advice to buyers is to try to buy ahead of further interest rate reductions.

Conclusion

For buyers who remain concerned with the price of a fixed-rate mortgage, I’ve seen 7/1 adjustable rate mortgages (ARMs) as low as 6.125% (7 years at the fixed rate of 6.125% before adjusting to the prevailing market rate). If you believe, as I do, that mortgage rates will get as low as 5.5% over the next 24 months, then taking out an ARM and refinancing in a couple of years may be a smart move. If you need a referral to a great, local mortgage broker, please reach out.

Sellers remain in a strong position and ongoing rate declines will both help them better afford new mortgages when they move, and continue to encourage more buyers to enter the market. That said, you can never reliably time the market in the short-run. It’s generally safer, and far less stressful, to let your personal circumstances dictate your selling plans.

Rates are likely to be bumpy throughout 2024 with a gradual decline over the next 9 months. However, once we get into the election season, all bets are off. Markets despise uncertainty and we are undoubtedly going to be in an uncertain political climate between early November and the end of the year. If you’re contemplating a real estate purchase or sale in 2024, I strongly encourage you to make a move prior to November.

Regardless, I’m always interested to learn more about your long-term real estate goals and help advise you on the best path forward. My goal is to help you make the most financially rational, yet emotionally comfortable decision on your real estate future. Sometimes those goals are at odds with each other, but I continually strive to strike a delicate balance.